SGB Bank: entrance to your personal account. About the bank Recognition and awards

|

01 February 2020 01 January 2020 01 December 2019 01 November 2019 01 October 2019 01 September 2019 01 August 2019 01 July 2019 01 June 2019 01 May 2019 01 April 2019 01 March 2019 01 February 2019 01 January 2019 01 December 2018 01 November 2018 01 October 2018 01 September 2018 01 August 2018 01 July 2018 01 June 2018 01 May 2018 01 April 2018 01 March 2018 01 February 2018 01 January 2018 01 December 2017 01 November 2017 01 October 2017 01 September 2017 01 August 2017 01 July 2017 01 June 2017 01 May 2017 01 April 2017 01 March 2017 01 February 2017 01 January 2017 01 December 2016 01 November 2016 01 October 2016 01 September 2016 01 August 2016 01 July 2016 01 June 2016 01 May 2016 01 April 2016 01 March 2016 01 February 2016 01 January 2016 01 December 2015 01 November 2015 01 October 2015 01 September 2015 01 August 2015 01 July 2015 01 June 2015 01 May 2015 01 April 2015 01 March 2015 01 February 2015 01 January 2015 01 December 2014 01 November 2014 01 October 2014 01 September 2014 01 August 2014 01 July 2014 01 June 2014 01 May 2014 01 April 2014 01 March 2014 01 February 2014 01 January 2014 01 December 2013 01 November 2013 01 October 2013 01 September 2013 01 August 2013 01 July 2013 01 June 2013 01 May 2013 01 April 2013 01 March 2013 01 February 2013 01 January 2013 01 December 2012 01 November 2012 01 October 2012 01 September 2012 01 August 2012 01 July 2012 01 June 2012 01 May 2012 01 April 2012 01 March 2012 01 February 2012 01 January 2012 01 December 2011 01 November 2011 01 October 2011 01 September 2011 01 August 2011 01 July 2011 01 June 2011 01 May 2011 01 April 2011 01 March 2011 01 February 2011 01 January 2011 01 December 2010 01 November 2010 01 October 2010 01 September 2010 01 August 2010 01 July 2010 June 2010 01 May 2010 01 April 2010 01 March 2010 01 February 2010 01 January 2010 01 December 2009 01 November 2009 01 October 2009 01 September 2009 August 2009 July 1, 2009 June 1, 2009 May 1, 2009 April 1, 2009 March 1, 2009 01 February 2009 01 January 2009 01 December 2008 01 November 2008 01 October 2008 01 September 2008 01 August 2008 01 July 2008 01 June 2008 01 May 2008 01 April 2008 01 March 2008 01 February 2008 01 January 2008 01 December 2007 01 November 2007 01 October 2007 01 September 2007 01 August 2007 01 July 2007 01 June 2007 01 May 2007 01 April 2007 01 March 2007 01 February 2007 01 January 2007 01 December 2006 01 November 2006 01 October 2006 01 September 2006 01 August 2006 01 July 2006 01 June 2006 01 May 2006 01 April 2006 01 March 2006 01 February 2006 01 January 2006 01 December 2005 01 November 2005 01 October 2005 01 September 2005 01 August 2005 01 July 2005 01 June 2005 01 May 2005 01 April 2005 01 March 2005 01 February 2005 01 January 2005 December 1, 2004 November 1, 2004 October 1, 2004 01 September 2004 01 August 2004 01 July 2004 01 June 2004 01 May 2004 01 April 2004 01 March 2004 01 February 2004 |

Select a report: |

Under the reliability of the bank we mean a set of factors under which the bank is able to fulfill its obligations, have an adequate margin of safety in crisis situations, and not violate the standards and laws established by the Bank of Russia.

It should be borne in mind that only on the basis of reporting it is impossible to accurately determine the degree of reliability of the bank, so the study below is indicative.

Bank stability is the ability to withstand any external influences. Dynamics over a certain period may show stability (either improvement or deterioration) of various indicators, which may also indicate the stability of the bank.

Public Joint Stock Company "SEVERGAZBANK" is large Russian bank and among them ranks 86th in terms of net assets.

As of the reporting date (January 01, 2020), the net assets of BANK SGB amounted to 59.87 billion rubles Per year assets increased by 8.02%. Growth of net assets negative affected the return on assets ROI: over the year, the net return on assets fell from 1.22% to 0.82% .

In terms of services rendered, the bank mainly attracts client money, and these funds are sufficient diversified(between legal entities and individuals), and invests funds are mainly loans.

BANK SGB - has the right to work with non-state pension funds that provide mandatory pension insurance

, and can attract pension savings and savings for housing for military personnel; has the right to open accounts and deposits in accordance with the law 213-FZ of July 21, 2014.

, i.e. organizations of strategic importance for the military-industrial complex and security of the Russian Federation; to a credit institution appointed authorized representatives of the Bank of Russia.

Liquidity and reliability

The bank's liquid assets are those bank funds that can be quickly turned into cash in order to return them to depositor customers. To assess liquidity, consider a period of approximately 30 days, during which the bank will be able (or not able) to fulfill part of its financial obligations (because no bank can repay all obligations within 30 days). This "part" is called the "proposed outflow". Liquidity can be considered an important component of the concept of bank reliability.

Brief Structure highly liquid assets present in the form of a table:

| Name of indicator | January 01, 2019, thousand rubles | January 01, 2020, thousand rubles | ||

|---|---|---|---|---|

| cash on hand | 1 687 110 | (5.71%) | 1 282 874 | (4.59%) |

| funds on accounts with the Bank of Russia | 1 782 985 | (6.03%) | 1 719 583 | (6.15%) |

| NOSTRO correspondent accounts in banks (net) | 197 939 | (0.67%) | 303 082 | (1.08%) |

| interbank loans placed for up to 30 days | 21 427 896 | (72.51%) | 23 528 319 | (84.12%) |

| highly liquid valuable papers RF | 4 160 781 | (14.08%) | 1 137 389 | (4.07%) |

| highly liquid securities of banks and states | 347 414 | (1.18%) | (0.00%) | |

| highly liquid assets, taking into account discounts and adjustments (based on Ordinance No. 3269-U dated May 31, 2014) | 29 552 013 | (100.00%) | 27 971 354 | (100.00%) |

From the table of liquid assets, we see that the amounts of funds on accounts with the Bank of Russia, interbank loans placed for up to 30 days have slightly changed, the amounts of NOSTRO correspondent accounts in banks (net) have significantly increased, the amounts of funds on hand have decreased, the amounts of highly liquid securities have significantly decreased. securities of the Russian Federation, highly liquid securities of banks and governments, while the volume of highly liquid assets, taking into account discounts and adjustments (based on Ordinance No. 3269-U dated May 31, 2014), decreased over the year from 29.55 to 27.97 billion rubles

Structure current liabilities is shown in the following table:

| Name of indicator | January 01, 2019, thousand rubles | January 01, 2020, thousand rubles | ||

|---|---|---|---|---|

| deposits of individuals with a term of more than a year | 3 975 007 | (9.00%) | 4 957 408 | (10.49%) |

| other deposits of individuals (including individual entrepreneurs) (up to 1 year) | 14 749 678 | (33.39%) | 12 977 778 | (27.47%) |

| deposits and other funds of legal entities (up to 1 year) | 24 834 873 | (56.22%) | 27 345 964 | (57.89%) |

| including current funds of legal entities (without IP) | 13 424 310 | (30.39%) | 20 152 800 | (42.66%) |

| correspondent accounts of LORO banks | (0.00%) | (0.00%) | ||

| interbank loans received for up to 30 days | (0.00%) | 1 044 841 | (2.21%) | |

| own securities | 1 104 | (0.00%) | 4 000 | (0.01%) |

| obligations to pay interest, arrears, accounts payable and other debts | 611 233 | (1.38%) | 906 415 | (1.92%) |

| expected cash outflow | 12 220 004 | (27.66%) | 14 439 290 | (30.57%) |

| current liabilities | 44 171 895 | (100.00%) | 47 236 406 | (100.00%) |

During the period under review, the resource base experienced a slight change in the amounts of other deposits of individuals (including individual entrepreneurs) (for up to 1 year), deposits and other funds of legal entities (for up to 1 year), correspondent accounts of LORO banks , the amounts of deposits of individuals with a term of more than a year, obligations to pay interest, delays, accounts payable and other debts have increased, the amounts have increased significantly, incl. current funds of legal entities (without individual entrepreneurs), interbank loans received for up to 30 days, own securities, while the expected cash outflow increased over the year from 12.22 to 14.44 billion rubles

At the moment under consideration, the ratio of highly liquid assets (funds that are easily available to the bank over the next month) and the estimated outflow of current liabilities gives us the value 193.72% what says good margin of safety to overcome a possible outflow of funds from bank customers.

In correlation with this, the standards of instant (H2) and current (H3) liquidity are important for consideration, the minimum values of which are set at 15% and 50%, respectively. Here we see that the H2 and H3 standards are now at sufficient level.

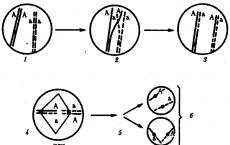

Now let's track the dynamics of change liquidity indicators during a year:

According to the median method (discarding sharp peaks): the sum of the norm of instant liquidity H2 during of the year unstable and tends to significant growth, but for the last half a year tends to decrease, the amount of the current liquidity ratio H3 during of the year tends to increase slightly, but over the last half a year tends to practically not change, and the expert reliability of the bank during of the year tends to decrease, but over the last half a year tends to decrease slightly.

Other coefficients for assessing the liquidity of the bank PJSC "BANK SGB" can be seen at this link.

Structure and dynamics of the balance sheet

The volume of assets generating income for the bank is 90.40% in total assets, and the volume of interest-bearing liabilities is 89.16% in total liabilities. However, the amount of earning assets exceeds the average indicator for large Russian banks (84%).

Structure earning assets at the moment and a year ago:

| Name of indicator | January 01, 2019, thousand rubles | January 01, 2020, thousand rubles | ||

|---|---|---|---|---|

| Interbank loans | 21 427 896 | (44.33%) | 29 048 319 | (53.67%) |

| Corporate loans | 7 109 572 | (14.71%) | 7 937 175 | (14.67%) |

| Loans to individuals | 10 468 343 | (21.66%) | 10 831 068 | (20.01%) |

| Bills | (0.00%) | (0.00%) | ||

| Investments in leasing operations and acquired rights of claim | 2 406 127 | (4.98%) | 2 804 829 | (5.18%) |

| Investments in securities | 6 515 188 | (13.48%) | 3 495 344 | (6.46%) |

| Other income-generating loans | 413 515 | (0.86%) | 4 044 | (0.01%) |

| Income assets | 48 340 641 | (100.00%) | 54 120 608 | (100.00%) |

We see that the amounts of Loans to legal entities, Loans to individuals, Promissory notes, Investments in leasing operations and acquired rights of claim have slightly changed, the amounts of Interbank loans have increased, the amounts of Investments in securities have greatly decreased, and the total amount of earning assets increased by 12.0% from 48.34 to 54.12 billion rubles

Analytics by degree of security issued loans, as well as their structure:

| Name of indicator | January 01, 2019, thousand rubles | January 01, 2020, thousand rubles | ||

|---|---|---|---|---|

| Securities accepted as collateral for issued loans | 14 714 212 | (66.35%) | 18 266 663 | (46.10%) |

| Property accepted as security | 7 916 949 | (35.70%) | 7 408 108 | (18.70%) |

| Precious metals accepted as collateral | (0.00%) | (0.00%) | ||

| Received guarantees and guarantees | 10 774 886 | (48.59%) | 14 034 012 | (35.42%) |

| Loan portfolio amount | 22 175 453 | (100.00%) | 39 625 264 | (100.00%) |

| - incl. corporate loans | 4 369 841 | (19.71%) | 6 359 026 | (16.05%) |

| - incl. physical loans persons | 10 468 343 | (47.21%) | 10 831 068 | (27.33%) |

| - incl. bank loans | 1 777 896 | (8.02%) | 18 048 319 | (45.55%) |

An analysis of the table suggests that the bank is focusing on diversified lending, the form of security of which is mixed types of collateral. notice, that specific gravity the most reliable form of security - the borrower's property (including precious metals and securities) significantly decreased to a value of 64.79%. The overall level of credit security is low, but sufficient, provided good quality security.

Brief structure interest liabilities(i.e. for which the bank usually pays interest to the client):

| Name of indicator | January 01, 2019, thousand rubles | January 01, 2020, thousand rubles | ||

|---|---|---|---|---|

| Funds of banks (interbank credit and correspondent accounts) | (0.00%) | 1 560 841 | (2.92%) | |

| Legal funds persons | 30 148 956 | (61.50%) | 32 374 039 | (60.65%) |

| - incl. current funds of legal entities. persons | 13 426 349 | (27.39%) | 20 179 164 | (37.80%) |

| Physical contributions. persons | 18 722 646 | (38.19%) | 17 908 822 | (33.55%) |

| Other interest-bearing liabilities | 151 856 | (0.31%) | 1 535 707 | (2.88%) |

| - incl. loans from the Bank of Russia | (0.00%) | 94 632 | (0.18%) | |

| Interest liabilities | 49 023 458 | (100.00%) | 53 379 409 | (100.00%) |

We see that the amounts of legal funds have changed slightly. individuals, deposits of individuals. persons, the amounts of funds of banks (interbank loans and correspondent accounts) increased significantly, and the total amount of interest-bearing liabilities increased by 8.9% from February 49 to 53.38 billion rubles

The structure of assets and liabilities of the bank PJSC "BANK SGB" can be considered in more detail.

Profitability

Profitability of sources of own funds (calculated according to balance sheet data) decreased over the year from 16.85% to 10.68%. At the same time, the return on equity ROE (calculated on forms 102 and 134) decreased over the year from 18.54% to 10.16%(here and below, data are given in percent per annum for the nearest quarterly date).

Net interest margin decreased over the year from 2.92% to 2.05%. Profitability of lending operations decreased over the year from 10.79% to 8.78%. The cost of funds raised has changed little over the year from 5.72% to 5.78%. The cost of household funds (individuals) has changed slightly over the year from

Currently, there are more than 500 commercial banks in Russia specializing in servicing individuals and legal entities. It is rather difficult for a potential client to choose a potential financial partner who will not only meet the requirements of the client, but also have a high degree reliability according to various expert estimates. One of these banks is the SGB bank. The official website is located at https://severgazbank.ru, however, a potential client should definitely get acquainted with the products and services of a financial institution, as well as customer reviews and other necessary information.

About bank

The history of the bank began in 1994, at that time the organization was called MarsBank Open Joint Stock Company. The main office was in the city of Vologda, the capital of the Vologda region. In 1997 it was renamed Severgazbank. In 2016, the bank changed its form of ownership to Severgazbank Public Joint Stock Company. The bank's logo is a blue flame, symbolizing purposefulness and a high growth rate.

Bank Svergazbank is a medium-sized bank in our country, its head office is located in the city of Vologda, Vologda region. In addition, the bank has a representative office in major cities: Moscow, St. Petersburg, Yaroslavl, Arkhangelsk, Ivanovo and others. The reliability of the bank is not in doubt, because at the moment it is a dynamically developing enterprise wholly owned by private individuals, that is, shares of the state or foreign capital it doesn't. At the moment, the bank has partnership relations with the Non-State Pension Fund GAZFOND for the accumulation of pensions, and is implementing several promising projects. Head of the Board Maxim Filatov.

SGB bank details:

- legal address 160001, Vologda, st. Blagoveshchenskaya, 3;

- BIC 041909786;

- TIN 3525023780;

- KPP 352501001;

- OKATO 19401000000;

- OKPO 19401000000;

- correspondent account of the main department 30101810800000000786.

Please note that at the moment the bank serves more than 28,000 legal entities and private entrepreneurs, as well as more than 700,000 private clients.

Bank services

If you look at the official website of Severgazbank, you can be sure that the bank offers a wide range of financial services both for private clients and individual entrepreneurs. Individuals can open a loan or a credit card in a bank, apply for a mortgage or open a deposit. Let's consider all services in more detail.

The conditions of a consumer loan will largely depend on which category the potential borrower belongs to, here customers can apply for a loan for various conditions. All potential bank borrowers are divided into several categories: pensioners, public sector employees, rural residents, gas industry employees and military personnel. The minimum rate on consumer loans is from 12% per year, the maximum amount is up to 1.5 million rubles. The maximum loan terms are up to 7 years, under similar conditions, you can get a car loan.

When applying for a consumer loan, a credit card with a limit of up to 500,000 rubles as a gift.

Mortgage loans are divided into several categories: for secondary housing and new buildings, military mortgages or refinancing mortgage loans. The interest rate is from 9.75% per year, the maximum mortgage amount is up to 60% of the value of the object. The bank works with government programs, namely mortgages for the military and maternity capital. In addition, Severgazbank offers its potential borrowers to purchase housing selected from a showcase of collateral.

Severgazbank offers a wide range of credit and debit cards. As for the credit limit, the interest rate is from 17.9% per year and above. The bank works with such payment systems as Visa, Mastercard and Mir. Terms of service are individual and depend on the type of card and its parameters.

For potential investors, it has several rather profitable offers, according to which the minimum amount is from 5,000 rubles, the interest rate is up to 7.7% per year. Deposit terms are flexible from 1 month to 2 years. Depending on the preferences of the owner of the deposit account, he can choose a deposit with different parameters, for example, capitalization of interest, replenishment and partial withdrawal cash.

But the peculiarity of the bank is that you can open a deposit account only online.

For legal entities, the bank also offers a wide range of financial services, namely:

- bank guarantee;

- loan for urgent needs;

- express loan;

- overdraft;

- leasing of agricultural machinery;

- leasing of commercial vehicles;

- salary project;

- merchant acquiring;

- checking account maintenance.

Remote maintenance

Every self-respecting commercial bank offers its customers a remote service system through an Internet service. This is a fairly convenient way to make financial transactions without visiting a bank branch. Through Internet banking, you can not only control your funds, but also perform a number of operations.

Severgazbank's personal account is available to bank customers 24/7. With the help of the Internet you can:

- control your accounts;

- receive statements on bank card transactions;

- transfer funds from one card to another;

- pay for services;

- open deposits;

- block the card in case of danger;

- receive consulting services from a bank specialist.

To use the remote service, you do not need to have certain skills and knowledge, the site interface is accessible and understandable even to not the most confident Internet users. In addition, the bank protects clients' funds, therefore, in order to gain access to your finances, you need to enter some identification data, namely login, password and one-time SMS code.

Another way to get advice from a qualified bank employee is to call the call center. Hot line of Severgazbank 8-800-700-25-52.

Bank reliability and financial indicators

At the moment, in the middle of 2017, Severgazbank ranks 102 in the rating of Russian banks. The authorized capital is 45.558 billion rubles, which is 4.8% more than in the previous period. The bank's loan portfolio is 132.319 billion rubles, of which approximately 70% are loans to legal entities and individual entrepreneurs. Total number of deposits individuals- 158.691 billion rubles.

Severgazbank Personal Area

The bank was established in 1994 in Vologda and registered as JSCB "Marsbank".

In 1997, it was renamed into CJSC Commercial Bank for the Development of the Gas Industry of the North Severgazbank. In 1999, the organizational and legal form was changed to an open joint stock company.

In 2000, the bank bought JSCB Magistral (Republic of Komi), LLC CB Ustyug-Bank and CJSC Vytegorsky Kombank and transformed them into its branches.

Until mid-2011, the financial institution was part of the Gazprombank group.

In December 2012 OJSC CB Severgazbank was renamed into OJSC SGB Bank.

In June 2015, the legal form was changed to PJSC. In March 2017, the full name of the bank was changed to Severgazbank PJSC (the abbreviated version remained the same - SGB Bank PJSC).

Until recently, the founder of the Alor brokerage company, well-known financier Anatoly Gavrilenko*, was the beneficiary of 100% of the bank's shares. In April 2016, NPF Gazfond, the founders of which are PJSC Gazprom and its three regional subsidiaries, as well as Gazprombank, became a shareholder.

As of October 1, 2019, the net assets of the bank amounted to 59.3 billion rubles, the volume of own funds - 5.5 billion rubles. According to the results of three quarters of 2019, the bank shows a profit of 265.1 million rubles.

Branch network:

head office (Vologda);

2 branches (Moscow, St. Petersburg);

1 representative office (Norilsk);

17 additional offices;

16 operating offices;

1 credit and cash office.

Owners:

Anatoly Gavrilenko - 55.00%;

JSC NPF Gazfond – 35.00%;

Bank GPB (JSC) - 10.00%.

Board of Directors: Evgeny Logovinsky (chairman), Oleg Byaloshitsky, Marina Malyutina, Sergey Nikitin, Alexey Nuzhdov, Alexander Sobol, Maxim Filatov.

Governing body: Maxim Filatov (chairman), Dilyara Moreva, Elena Chumaevskaya, Denis Lukichev, Alexey Novikov, Igor Zimin, Sergey Tishko, Anton Ladnov.

* Anatoly Gavrilenko is a well-known financier, founder and key shareholder of the Alor Group of Companies, since 2009 he has been the head of the Supervisory Board of the group. He holds a number of positions in public organizations of the financial sector, in various commercial and other organizations. In particular, he is the president of the Russian Exchange Union, the chairman of the Expert Council on financial literacy in the field at the Bank of Russia (the former FFMS), a member of the board of the Moscow Chamber of Commerce and Industry, the chairman of the supervisory board of the NP "Community of Professionals Financial Market"SAPPHIRE", a member of the exchange council of CJSC "St. Petersburg Stock Exchange" and others.

Alor Group of Companies is one of the largest financial groups RF. It was formed in 2003 on the basis of CJSC Alor Invest, the oldest of the group of companies, established in 1993. The companies included in the Alor Group are professional participants in the securities market and provide almost a full range of services to a wide range of investors. Currently, the group of companies is among the top 10 largest stock market operators on the Moscow Exchange, has 18 regional offices, and the group's client base exceeds 30,000 clients.

In early 2017, Forbes magazine named Anatoly Gavrilenko the head and co-owner of the largest pension group, which included non-state pension funds Gazfond Pension Savings, KIT Finance, Promagrofond and Heritage. At the beginning of April 2017, the transferred funds were merged with NPF Gazfond.

About the Bank

Public Joint Stock Company SEVERGAZBANK (PJSC BANK SGB) was founded in Vologda in 1994. Bank registered by the Central Bank Russian Federation April 29, 1994 under the number 2816. SEVERGAZBANK is a universal commercial bank that provides a wide range of services for individuals, corporate clients and government agencies. The bank serves more than 500 thousand individuals and 20 thousand legal entities.

The bank's branch network operates in 11 regions: Vologda, Arkhangelsk, Novgorod, Yaroslavl, Ivanovo, Volgograd and Saratov regions, the Komi Republic, St. Petersburg, Moscow and Norilsk. The bank has a network of over 400 ATMs and payment terminals. At the end of 2018, the bank's capital amounted to 4 billion rubles, the bank's assets - 53.8 billion rubles.

One of the owners of the bank is JSC NPF GAZFOND pension savings.

Positions of SEVERGAZBANK:

Top 100 largest banks by assets / banki.ru, Interfax - Center for Economic Analysis / as of December 31, 2018

Top 100 most reliable banks / Forbes magazine / 2018, 2019

Top 30 in terms of mortgage lending / Expert RA / 2018

Top 30 in terms of loans issued to small and medium-sized businesses / Expert RA / 1st half of 2018

Top 10 in terms of the number of guarantees provided to small and medium-sized businesses under 44-FZ / Multitender / 2017

Recognition and awards:

- "Best Regional Bank of the Year", competition "Financial Elite of Russia" / 2017, 2018

- « Best Bank Public-Private Partnership Projects in the Sphere of Transport Infrastructure” at the Investor Awards competition of the “Securities Market” magazine (for participation in the project of launching a high-speed tram service in St. Petersburg together with the strategic partner Management Company “Leader”) / 2017

Winner in the nomination "Affordable Mortgage" at the XIV International Prize in Economics and Finance. P.A. Stolypin of the magazine "Banking" / 2018

- "The Best Bank for Seniors 2018" according to the "National Banking Journal"

- "The best banking program for small and medium-sized businesses" at the "Silver Mercury" competition of the Vologda Chamber of Commerce and Industry of the Russian Federation

- "The Best Newspaper for Clients" at the competition of Russian corporate media "Medialeader-2018" (financial literacy newspaper "On Finance and Not Only")

Separate subdivisions of the Bank:

1. St. Petersburg branch of "BANK SGB"

Address/location: 198095, St. Petersburg, Marshal Govorov street, 35, letter A, room 2H

15.06.2004

2. Moscow branch "BANK SGB"

Address/location: 121069, Moscow, Sadovaya-Kudrinskaya st., 2/62, building 4

Date of entry of information in the book of state registration of credit institutions: 06.09.2012

3. Representative office of "BANK SGB" in Norilsk

Address/location: 663302, Krasnoyarsk Territory, Norilsk, Central District, st. Zavenyagina, d. 6, building 2, room. 160

Opening date: 25.12.2015

Naming history

From 1994 to 1997 The bank was called Closed Joint Stock Company Joint Stock Commercial Bank "MARSBANK".

By the decision of the annual general meeting of shareholders dated May 16, 1997, the Bank was renamed into Closed Joint Stock Company Commercial Bank for the Development of the Gas Industry of the North "SEVERGAZBANK" (License of the Central Bank of the Russian Federation No. 2816 dated 01.08.03).

In connection with the change in the type of joint-stock company from April 2, 1999, the full name of the Bank changed to Open Joint Stock Company Commercial Bank for the Development of the Gas Industry of the North "SEVERGAZBANK" (License of the Central Bank of the Russian Federation No. 2816 dated 01.08.03)

On August 26, 2002, a certificate was received on making an entry about the bank in the unified state register of legal entities for the main state registration number 1023500000160.

Since November 8, 2012, according to the decision of the annual general meeting of shareholders, the Bank bears the corporate name OJSC “BANK SGB”.

In order to bring the name and constituent documents of the Bank in line with the provisions of Chapter 4 of the Civil Code of the Russian Federation, from May 22, 2015, the name of the Bank was changed to PJSC BANK SGB.

By the decision of the sole shareholder No. 15 dated November 10, 2016, the full name of the bank was changed.

On December 23, 2016, an entry was made to the Unified State Register of Legal Entities about the registration of changes to the bank's charter with a new full name.

The full corporate name of the bank in Russian is Public Joint Stock Company SEVERGAZBANK.

The abbreviated corporate name of the bank in Russian remained the same - PJSC "BANK SGB".

Full company name of the bank English language- Public Joint-Stock Company "SEVERGAZBANK".

The bank's abbreviated corporate name in English is "BANK SGB" PJSC.

Bank Auditor - JSC KPMG