Reflection of a claim in accounting: postings. Claims from buyers Claims from buyers

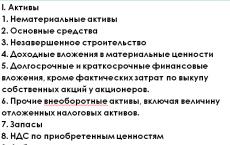

A claim may be made by the buyer to the supplier if:

- contractual obligations are violated;

- a shortage of incoming valuables was revealed;

- arithmetic errors were found in receipt documents.

Account 76.2 “Calculations on claims” is used for settlement of claims presented to the supplier or recognized. In this article, we will consider the aspects of registration of such an operation and settlement of claims in postings.

The claim settlement procedure is mandatory if such a dispute resolution procedure is determined by the Federal Law or the terms of the contract.

The claim is made in writing, the claim letter must reflect the requirements of the applicant and indicate the amount of the claim. The supplier organization considers the claim within 30 days and gives a written response to it.

If you agree to pay, the date is indicated - the number and amount of the payment document by which the debt is repaid. In case of refusal, a reference to the legislation is indicated in the letter.

If the supplier refuses to satisfy the claim, the purchasing organization has the right to go to court.

Accounting for customer claims

After considering the buyer's claim, the supplier can either decide to satisfy it or refuse.

LLC "Orchid" received from the supplier materials in the amount of 20,000 rubles. When checking, a shortage of 4,000 rubles was found.

The organization filed a claim with the supplier.

If the supplier has decided to satisfy the claim, then this is reflected in Orchid LLC as follows:

In case of refusal to compensate for the shortage, its amount is debited to the expense account:

If the supplier fails to comply with the terms of the contract, a fine, penalty or penalty is usually charged. These amounts are also reflected in the expense account.

Accounting for supplier claims

If the buyer returns the goods that he has already managed to credit with himself, then, according to the Ministry of Finance and the Federal Tax Service, this operation belongs to the reverse sale. The reason for returning the item is irrelevant. In this operation, the buyer is obliged to issue an SF on the returned goods.

The buyer may submit the following requirements:

- return of advance payment for unfulfilled obligations;

- issue a replacement or return of marriage;

- eliminate defects;

- reduce the price of the contract;

- pay fines or penalties.

Upon receipt of a claim, the seller organization has the right to both recognize it and refuse to recognize it. Unrecognized claims do not affect the calculation of income tax.

If a claim is recognized, its accounting depends on the nature of the claim.

Failure to comply with the terms of the contract

If the terms of the contract are violated by the buyer, for example, they were not paid after the shipment of the goods, then the seller has the right to require the buyer to pay a penalty or interest for the delay. Moreover, the law does not provide for the simultaneous collection of both a penalty and interest, except when it is prescribed in the contract.

Podmoskovnye prostory LLC in April 2015 sold a consignment of materials to Podsolnukh LLC in the amount of 138,000 rubles, incl. VAT 21051 rubles. The buyer "Sunflower" overdue payment for 9 days. The amount of the penalty for late payment is 0.15% of the amount of payment for each day of delay.

Podmoskovnye Prostory LLC made a claim to the buyer for the amount of the penalty:

- 138000 * 0.15% * 9 \u003d 1863 (rubles).

Postings at Podmoskovnye prostory LLC.

Account 76.2 is used to account for amounts and analyze transactions for claims and penalties issued by the buyer and received by the supplier. With the help of illustrative examples and specific situations, we will help you understand the rules for accounting for claims and the features of using account 76.2.

Account 76.2 accounting for claims settlements: use

Sub-account 76.2 reflects the amounts accounted for according to the claims letters received by suppliers and issued by customers.

Claim letters can be drawn up in connection with the unsatisfied terms of the concluded contracts, namely: (click to expand)

- violation of delivery terms;

- non-compliance of goods with qualitative (quantitative) characteristics;

- violation of the completeness of the goods, lack of necessary packaging, etc.;

- goods not delivered (works, services not performed).

The amounts of claims submitted are accounted for under Dt 76.2; for operations with received claims, Kt 76.2 is used.

Consider the main wiring:

| Debit | Credit | Description | Document |

| 76.2 | 20 | A claim for downtime (marriage) caused by the fault of the contractor was recognized. The amount of the claim is reflected at the expense of the costs of the main production | Claim letter |

| 76.2 | 23 (29) | A claim for downtime (marriage) caused by the fault of the contractor was recognized. The amount of the claim is reflected at the expense of the costs of auxiliary production (servicing facilities) | Claim letter |

| 76.2 | 28 | The amount of losses from marriages that arose through the fault of the contractor and are subject to recovery | Claim letter |

| 10 | 76.2 | The amount of the claim satisfied by the supplier of materials has been taken into account | Claim letter |

| 41 | 76.2 | The amount of the claim satisfied by the supplier of goods (due to their shortage) | Claim letter |

Accounting for customer claims

To consider operations on claims in accounting with the buyer, we use illustrative examples.

Claim for lack of delivery of goods

JSC "Fermer" supplied LLC "Ambar" a batch of materials (seeds of agricultural crops) in the amount of 134.800 rubles, VAT 20.563 rubles. The contract between "Farmer" and "Ambar" states that the loss of materials associated with the transportation process should not exceed 2.5%, that is, 3.370 rubles, VAT 514 rubles. (134.800 rubles * 2.5%).

Upon acceptance of the goods at the warehouse of Ambar LLC, a shortage of materials was revealed in the amount of 5.720 rubles, VAT 873 rubles. A claim was made for the amount of the identified shortage, according to which “Farmer” repaid the cost of the missing materials.

The following entries were made in the account of “Ambar”:

| Debit | Credit | Description | Sum | Document |

| 10 | 60 | A batch of seeds (134.800 rubles - 20.563 rubles - 5.720 rubles - 873 rubles) arrived at the warehouse of Ambar LLC. | 107.644 rub. | Bill of lading, Reconciliation act |

| 19 | 60 | The amount of VAT on actually received seeds was taken into account (20.563 rubles - 873 rubles) | 19.690 rub. | Invoice |

| 94 | 60 | The cost of seeds is taken into account, the amount of natural loss of which is provided for by the contract | 3.370 rub. | Contract of sale |

| 76.2 | 60 | A claim was made to “Farmer” for a shortage in the supply of materials in excess of the norm established by the contract (5.720 rubles - 3.370 rubles) | 2.350 rub. | Claim letter |

| 51 | 76.2 | Funds from the "Farmer" were credited to pay off the debt on the submitted claim | 2.350 rub. | Bank statement |

Advance payment not processed by the supplier

JSC "Segment" and JSC "Sector" concluded a contract for the supply of electrical goods:

- date of conclusion of the contract - 06/18/2015;

- On June 23, 2015, Segment JSC made an advance payment for electrical goods in the amount of 541,600 rubles, VAT 82,617 rubles. (100% prepayment);

- the delivery date of the goods is 03.08.2015.

JSC "Sector" did not deliver under the contract within the prescribed period, in connection with which "Segment" filed a claim demanding to terminate the contract and return the previously transferred advance. The claim was satisfied by Sector JSC in full.

The accountant of the Segment made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 60 Advances issued | 51 | Funds were transferred in favor of Sector JSC as an advance payment for the supply of electrical goods | 541.600 rub. | Payment order |

| 68 VAT | 76 VAT on advances issued | VAT from the amount of the advance transferred in favor of Sector JSC is accepted for deduction | 82.617 rub. | Invoice |

| 76.2 | 60 Advances issued | The amount of the claim made by Sector JSC for violation of the terms of supply of electrical goods has been taken into account | 541.600 rub. | Claim letter |

| 51 | 76.2 | Crediting funds from Sector JSC on a claim | 541.600 rub. | Bank statement |

| 76 VAT on advances issued | 68 VAT | The amount of VAT previously accepted for deduction has been restored | 82.617 rub. | Invoice, Claim letter, Bank statement |

Video reference “Accounting for account 76”: sub-accounts, postings, examples

Video lesson on accounting for account 76 “Settlements with different debtors and creditors”, sub-accounts, postings and examples of operations. Lead by the teacher of the site “Accounting and tax accounting for dummies”, chief accountant Gandeva N.V. ⇓

Operations with claims in vendor accounting

Let's consider examples of accounting for claims received.

Penalty for breach of contract

Hidden text

- delivery amount - 1.257.300 rubles, VAT 191.792 rubles;

- payment term under the contract - 18.03.2016;

- the amount of the penalty for violation of the terms of payment under the contract is 0.15% of the amount of the debt for each day of delay in payment.

Nefertiti LLC received payment for the shipped freezers on 03/25/2016, in connection with which Ramses JSC filed a claim containing the following calculation:

1.257.300 rub. * 0.15% * 8 days = RUB 15.088

The amount of the penalty was repaid by Ramses JSC in full.

The following entries were made in the accounting of Ramses JSC:

Satisfaction of the right to return the received advance payment

Mramor LLC and Kremniy JSC signed a contract for the supply of washing machines:

- date of conclusion of the contract - 03/03/2016;

- delivery time of the goods - 08.04.2016;

- delivery cost - 751.650 rubles, VAT 114.659 rubles.

03/12/2016 "Mramor" made a full prepayment under the contract, but the washing machines were not delivered on time. "Mramor" initiated the termination of the contract and filed a claim demanding the return of the advance paid earlier in favor of "Silicon".

After considering the claim, Kremniy returned the money and terminated the contract.

The accountant of Silicon made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 51 | 62 Advances received | Crediting of funds received from Mramor LLC as an advance payment for the forthcoming delivery of washing machines | 751.650 rub. | Bank statement |

| 76 VAT on advances received | 68 VAT | VAT charged on the amount of the advance received from Mramor | 114.695 rub. | Invoice |

| 68 VAT | 51 | VAT amount transferred to the budget | 114.695 rub. | Payment order |

| 62 Advances received | 76.2 | Accounted for the amount of debt to LLC "Mramor" in connection with the violation of the terms and subsequent termination of the contract | 751.650 rub. | Claim letter |

| 76.2 | 51 | Funds were transferred in favor of Mramor LLC to pay off the debt on the received claim | 751.650 rub. | Payment order |

| 68 VAT | 76 VAT on advances received | The amount of VAT accrued earlier from the received advance is accepted for deduction | 114.695 rub. | Invoice, Claim letter |

When making settlements with counterparties, there may be a violation of contractual relations or shortages in settlements, as well as errors in the accepted documents.

In such situations, it is necessary to claims settlements, postings, reflecting these calculations, according to the chart of accounts, are performed using account 76.2. We will analyze in detail how to file a claim, which is reflected on account 76.2, we will give the main transactions using this account, we will talk about accounting and tax accounting for claims settlements.

Claim settlement algorithm

To file a claim, you need to follow two simple steps:

1. The claim is made in writing, which indicates the requirements of the applicant and the amount of money required for payment, as well as the date - the letter of claim and is transferred to the counterparty.

2. After considering the claim, the counterparty either accepts the claim or refuses.

Important: It is mandatory to notify the counterparty of the claim that has arisen (Article 483 of the Civil Code of the Russian Federation). You should apply to the court only after notifying the counterparty. The statement of claim to the court will not be accepted if the counterparty has not been presented with a claim (Article 128 of the Arbitration Procedure Code and Article 136 of the Civil Procedure Code)

At the same time, it is important to do everything correctly claims settlements. Accounting and tax accounting, postings when working with claims are quite simple and we will analyze them in detail. Postings on claims go through subaccount 76.2.

Settlement of claims: postings on account 76.2

Claim settlements performed using sub-account 76.2. This account reflects the amounts that are billed by the customer on the basis of letters of claim. A claim letter is issued for violation of the terms of the contract with the counterparty, namely:

- Non-delivery of goods or failure to perform work prescribed in the contract

- Violation of deadlines, such as deadlines for delivery or execution of work

- Non-compliance of the goods with the description in the contract, for example, in terms of quality or other characteristics

- Violation of the configuration, integrity or packaging

Important: When using account 76.2, a debit account is used for the amounts of claims submitted, a credit account is used for the amounts with received claims

Settlements on claims: accounting and tax accounting, postings

Claims are settled using account 76.2. The most commonly used transactions using this account are shown in the table.

Debit |

Credit |

Description |

|---|---|---|

|

The claim was recognized as the fault of the counterparty. The amount of the claim is taken into account at the expense of the costs of the main production |

||

|

The claim was recognized as the fault of the counterparty. The amount of the claim is taken into account at the expense of the costs of ancillary production |

||

|

Accounting for the amount of losses from marriage that arose due to the fault of the counterparty and are recoverable |

||

|

Claim amount paid to suppliers and contractors |

||

|

Accounting for the amount of the claim, which was satisfied by the supplier of materials |

||

|

Accounting for the amount of the claim, which was satisfied by the supplier of goods (due to the shortage of delivered goods) |

||

|

Reflection of the amount of the claim presented by suppliers for debts not paid on time, upon recognition |

Examples of postings when calculating claims

Let's give an example of using account 76.2. Suppose that Titan LLC purchased equipment in the amount of 1,000,000 rubles. When receiving the equipment, an error was found in the financial documents - a shortage of 50,000 rubles. That is, we have:

If the organization satisfies the claim, then we have

In case of refusal, if it is necessary to write off the shortage

|

Debit |

Credit |

Sum |

Operation |

|

Shortage write-off |

How to search for transactions using the Transaction Bank

You can choose the wiring for any operation

Tax accounting of settlements on claims

According to Art. 265 of the Tax Code of the Russian Federation, expenses in the form of fines recognized by the debtor, penalties, etc. for violation of contractual obligations, as well as the costs of compensation for damage caused, are included in non-operating expenses when calculating income tax.

Important: all calculations for claims must be documented.

To document the expenses, the organization must draw up a document recognizing the damage caused to it, and send this claim document to the counterparty. The document indicates the nature of the claim and the amount.

Claim work can be started as a result of a violation by one of the parties of the terms of cooperation, if there are shortages in the delivered batch of products, if there are counting errors in the received accounting documents. Oral claims are not legally binding. To obtain clarification from the counterparty and correct the error, it is necessary to send a written claim to his address.

Reflection of a claim in accounting: postings with the buyer

In accounting, claims made to suppliers are displayed on account 76.2. Account analytics is conducted in the context of each completed claim. The buyer, if there are grounds for a dispute with the counterparty, draws up a claim letter. The supplier must respond to the customer's claims - agree with the buyer's opinion and fulfill the contractual terms in full, or refuse to fulfill it. In the latter case, the buyer has the right to file a lawsuit.

When a marriage is detected, a claim is reflected in accounting (postings) by debiting account 76.2 with simultaneous crediting of one of the cost accounts ( , , ), if prices do not meet the conditions of standards, counting errors, etc. credit score 60 . If the supplier considers the customer's requirements reasonable, he satisfies them. In the accounting of the buyer, receivables in the form of a claim are repaid when posting a credit turnover according to 76.2.

Example

LLC "Expert" ordered material assets from LLC "Korund" on a prepaid basis. The amount of the transaction is 2575 rubles. At the time of shipment, a shortage of 575 rubles was revealed. The buyer filed a claim, the entries in the accounting reflected the amount of the shortage as the debt of the counterparty. The supplier satisfied the customer's requirements by returning the shortfall amount. Later, a shortage of purchased valuables from another supplier, Orient LLC, in the amount of 700 rubles was discovered, the counterparty refused to satisfy the claim.

Correspondence in the account:

- D60 - K51 - 2575 rubles, payment for goods and materials of Korund LLC

- D10 - K60 - 2000 rubles. (2575 - 575), posting of actually received valuables;

- D76.2 - K60 - 575 rubles, a claim has been made, postings are formed according to the analytical sub-account of Korund LLC;

- D51 - K76.2 - 575 rubles, the claim was satisfied by the supplier.

- D 76.2 - K60 - 700 rubles, the claim was sent to Orient LLC;

- D94 - K76.2 - 700 rubles, Orient LLC does not recognize the mistake, compensation for the shortage will not be made, the amount is written off as expenses.

Postings on claims from buyers: accounting with the supplier

Upon receipt of a claim from the buyer, the supplier can take one of the following decisions:

- return the amount received from the counterparty (in part or in full, depending on the type of violation);

- replace defective products;

- take back non-working equipment

- eliminate defects;

- adjust the contractual prices in the direction of their reduction;

- charge and pay a penalty or penalty.

If the supplier agrees with the content of the claim letter, is ready to accept defective products and reimburse their cost, such a return procedure will be carried out as a reversal sale.

Example

Sharm LLC sold inventory items in the amount of 5,800 rubles, including VAT of 1,044 rubles. The buyer's payment for the product is overdue by 3 days. Under the terms of the contract, a penalty is charged for late payment. The amount of the penalty rate is 0.09% per day.

Supplier postings:

- D76.2 - K91.1 - a penalty in the amount of 18.48 rubles was recognized. (6,844 x 0.09% x 3).;

- D51 - K76.2 - the buyer satisfied the requirements for the claim letter, the penalty was paid in the amount of 18.48 rubles.

If the buyer transferred the payment for the products in advance, and the supplier delayed the delivery, then there would be grounds for conducting claims work. Postings on claims from buyers look like the supplier:

- D51 - K62 - prepayment received;

- D62 - K76.2 - the requirements for the claim are taken into account and the company's debt to the client is reflected;

- D76.2 - K51 - satisfaction of the requirements of the buyer.

Submit your claim in writing. At the same time, clearly indicate what obligations the counterparty did not fulfill, the provisions of which document were violated (protocol, contract, agreement, etc.), offer your way out of the current conflict situation.

Attention: if the organization decides to file a claim with the counterparty, notify him in a timely manner that a violation of the terms of the contract has been identified. Otherwise, he may refuse to satisfy the claim (see, for example, Article 483 of the Civil Code of the Russian Federation). If the organization decides not to file a claim, but immediately goes to court, its claim will not be considered.

For example, when making a claim, the buyer must notify the seller of a violation of the terms of the contract of sale on the quantity, assortment, quality, completeness, container and (or) packaging of the goods within the period prescribed by law, other legal acts or the contract. And if such a period is not established, - within a reasonable time after the violation of the relevant term of the contract should have been discovered based on the nature and purpose of the goods. This procedure is established in Article 483 of the Civil Code of the Russian Federation.

Practical example of compiling accounting entries No. 1

Solntse Limited Liability Company ordered the supply of fire hoses for resale from the supplier OOO Zori. The total price of the order is 150,000 rubles, incl. VAT 18% - RUB 22,881.35 The goods were delivered on time, but the head of the warehouse revealed a shortage of products in the amount of 17,000 rubles, incl. VAT 18% - RUB 2,593.22 On the fact of underdelivery of sleeves, a request was sent to return the payment for the goods.

Accounting entries in the accounting of Solntse LLC:

- Dt60 Kt51: 150,000 rubles - the supply contract is fully paid by the buyer by bank transfer;

- Dt41 Kt60: 133,304.87 rubles - received products were credited to the warehouse;

- Dt19 Kt60: 20,288.13 rubles. – input VAT is taken into account;

- Dt76.02 Kt60: 17,000 rubles. – a claim was sent to Zori LLC;

- Dt51 Kt76.02: 17,000 rubles - the supplier satisfied the requirements of the buyer and returned the overpaid money to the buyer.

Debt adjustment: mutual settlements between the Solntse and Dawn organizations have been made in full, there are no debts under the contract.

According to the supply agreement, between Shield LLC and Mech LLC, payment by the Shield company for the delivered products must be made no later than the day following the day the goods arrive at the warehouse. The agreement between the firms provides for a penalty in the amount of 0.01% of the price of the goods for each calendar day of delay in payment.

Delivery cost - 70,000 rubles; the goods were delivered to the warehouse of Shield LLC on 06/10/2018, payment to the supplier was received on 06/19/2018.

Calculation of the penalty: 70,000 * 0.01 * 9 = 6,300 rubles.

Accounting entries in the accounting of Shield LLC:

- Dt91.02 Kt76.02: 6,300 rubles - the supplier's claim for failure to pay for the goods is displayed;

- Dt76.02 Kt51: 6,300 rubles. - the accrued penalty was paid in full.

Sinitsa Limited Liability Company entered into a supply agreement with the Yakor organization for the supply of grain crushers. The amount of the order of Sinitsa LLC was 300,000 rubles (including 18% VAT - 45,762.71 rubles). The Yakor company failed to fulfill its obligations under the contract. The customer filed a claim with the requirement to return the previously paid advance payment for non-delivered products. The management of the Yakor company accepted the claim and satisfied the buyer's requirements.

Accounting entries for business transactions in the accounting of Yakor LLC:

- Dt51 Kt62: 300,000 rubles - an advance payment was received on the current account;

- Dt76AB Kt68: 45,762.71 rubles - VAT charged on the buyer's advance;

- Dt62 Kt76.02: 300,000 rubles - a claim was received from the Sinitsa company for reasons of violations of the terms of the supply contract;

- Dt76.2 Kt51: 300,000 rubles - the claim was satisfied, and the customer's advance payment was returned to the current account;

- Dt68 Kt76AV: 45,762.71 rubles - acceptance for the deduction of previously accrued VAT from the advance.

In case of refusal, a reference to the legislation is indicated in the letter. If the supplier refuses to satisfy the claim, the purchasing organization has the right to go to court. Accounting for claims from the buyer After considering the buyer's claim, the supplier can either decide to satisfy it or refuse.

LLC "Orchid" received from the supplier materials in the amount of 20,000 rubles. When checking, a shortage of 4,000 rubles was found. The organization filed a claim with the supplier.

Debit account Credit account Posting description 76.02 20 Recognized claim for downtime or defect due to the fault of the contractor in the main production 76.02 23 Recognized claim for downtime or defect due to the fault of the contractor in auxiliary productions 76.02 29 Recognized claim for downtime or defect due to the fault of the contractor in service facilities 76.

02 28 A claim for the supply of low-quality materials that caused defective products was recognized 76.02 41 A claim was recognized for detected errors in goods delivered after they were accepted to the inventory warehouse 76.02 organization accounts 76.

At the same time, clearly indicate what obligations the counterparty did not fulfill, the provisions of which document were violated (protocol, contract, agreement, etc.), offer your way out of the current conflict situation. Attention: if the organization decides to file a claim with the counterparty, notify him in a timely manner that a violation of the terms of the contract has been identified.

Otherwise, he may refuse to satisfy the claim (see, for example, Article 483 of the Civil Code of the Russian Federation). If the organization decides not to file a claim, but immediately goes to court, its claim will not be considered. It is impossible to go to court without going through the stage of pre-trial resolution of disputes (for example, immediately write a statement of claim for the recovery of a penalty).

This follows from Article 128 of the Arbitration Procedure Code of the Russian Federation and Article 136 of the Civil Procedure Code of the Russian Federation.

VAT paid to the supplier as part of the advance payment. By the deadline set in the contract, Hermes did not have time to purchase the required amount of products and did not deliver. On November 21, Alfa filed a claim against Hermes for violation of the term for fulfilling the contract with a request to terminate it. On November 22, the contract between Hermes and Alpha was terminated.

- the supplier's debt is reflected in the advance payment amount subject to return due to termination of the contract for the submitted claim; Debit 51 Credit 76-2– 590,000 rubles. – the unworked advance payment is returned by the supplier; Debit 76 subaccount "VAT settlements from advances issued" Credit 68 subaccount "VAT settlements" - 90,000 rubles.

Accounting for claims from the supplier If the buyer returns the goods that have already been credited at home, then, according to the Ministry of Finance and the Federal Tax Service, this operation refers to reverse sale. The reason for returning the item is irrelevant. In this operation, the buyer is obliged to issue an SF on the returned goods. The buyer may submit the following requirements:

- return of advance payment for unfulfilled obligations;

- issue a replacement or return of marriage;

- eliminate defects;

- reduce the price of the contract;

- pay fines or penalties.

Upon receipt of a claim, the seller organization has the right to both recognize it and refuse to recognize it.

Unrecognized claims do not affect the calculation of income tax. If a claim is recognized, its accounting depends on the nature of the claim.

Depreciation groups: fixed asset classification updated The Government of the Russian Federation has corrected the classifier of fixed assets by depreciation groups. The amendments come into force retroactively - from 01/01/2018. (amp)lt; ... It is impossible to issue a copy of SZV-M to a resigning employee According to the law on accounting, the employer, upon dismissal of an employee, is obliged to issue copies of personalized reports to him (in particular, SZV-M and SZV-STAZH).

As a result of the investigation conducted by the “Seller”, it was reliably proved that the driver Ivanov stole the missing brick for personal needs. The organization ordered Ivanov (in writing) to compensate for his cost. In the accounting of the "Seller" this was reflected in the postings: DEBIT 73-2 CREDIT 94 - 9000 rubles - the amount of damage was attributed to Ivanov; DEBIT 70 CREDIT 73-2 - 9000 rubles - the amount of the shortfall was withheld from Ivanov's salary.

Attention

Please note: since the employee compensates for the damage caused by the crime (theft), the amount of deductions for each salary payment should not exceed 70 percent. If the culprit of the shortage was not identified or the court refused to recover, its amount will have to be written off as losses: DEBIT 91-2 CREDIT 94 - the shortage is included in other expenses. This loss reduces the taxable profit in accordance with paragraph 13 of Article 265 of the Tax Code of the Russian Federation.

In case of late payment for the delivered goods, the buyer, according to the terms of the contract, must pay a penalty. The amount of the penalty is 0.1 percent of the amount of debt for payment for goods for each day of delay. Alfa transferred payment for the delivered goods to Hermes only on March 24. On March 25, Hermes filed a claim against Alfa for payment of a penalty for late payment under the contract (the delay was 31 days).

The amount of the penalty for late payment for the goods amounted to: 120,000 rubles. × 0.1% × 31 days = 3720 rubles. "Alpha" recognized the claim of "Hermes" and paid a penalty. In the Hermes accounting, the accountant made entries: Debit 76-2 Credit 91-1– 3720 rubles. - a penalty is charged for violation of the deadline for payment for the goods; Debit 51 Credit 76-2– 3720 rubles. - received a penalty. Hermes pays income tax on a monthly basis, using the accrual method.

The accountant of ROMASHKA LLC generated the following postings for claims from the supplier JSC VESNA: Debit account Credit account Posting amount, rub. Description of the transaction Base document 91.02 76.02 8,500.00 The forfeit is reflected in the accounting Letter - claim 76.02 51 8,500.00 The amount of the recognized forfeit is transferred Bank statement Example 2. Claim received from the buyer - posting from the supplier to return the received advance

between the organization JSC "VESNA" and the buyer LLC "ROMASHKA" an agreement was concluded for the supply of goods for a total amount of 650,000.00 rubles, incl. VAT RUB 99,152.54 The delivery time under the terms of the contract is 01.03.2016. Buyer LLC "ROMASHKA" 15.01.2016 transferred the full prepayment according to the terms of the contract.

Accounting on account 76 is carried out in the event of situations that are not described in the explanation to accounts 60-76. Such operations, as a rule, include settlements on submitted and received claims and sums insured. Also on this account, deductions are kept in accordance with judicial, executive and other administrative documents.

| Dt | ct | Description | Document |

| 76.01 | 44 | Written off selling expenses incurred in connection with the insured event | Insurance contract |

| 76.02 | 60 | The amount of the claim due to the fault of the supplier is taken into account | Claim |

| 76 | 70 | The amount of funds due to the employee from other organizations is taken into account | Performance list |

| 58 | 73.03 | Securities credited as dividends | Minutes of the decision of the board |

| 66 | 76 | The loan was repaid by offsetting homogeneous claims | Loan agreement |

Terms of consideration of the claim

The counterparty is obliged to consider the claim. The deadline for this can be set:

- legislation (see, for example, paragraph 5 of article 12 of the Law of June 30, 2003 No. 87-FZ);

- the internal regulations of the organization or the customs of business.

This follows from Article 309 of the Civil Code of the Russian Federation.

At the same time, civil law does not establish sanctions for violation of this period (see, for example, Article 12 of the Law of June 30, 2003 No. 87-FZ or Article 37 of the Law of July 17, 1999 No. 176-FZ).

Do not provide for any sanctions and norms of judicial law (Arbitration Procedure Code of the Russian Federation, Code of Civil Procedure of the Russian Federation).

Financial sanctions (for example, a fine) for violating the deadline for considering a claim may be provided for in the contract with the counterparty (clause 4, article 421 of the Civil Code of the Russian Federation).

Basic requirements for a claim

The buyer's claim to the seller is made in writing in any form, but must contain the following information:

- Addressee and sender. As a rule, this appeal is filled out in the name of: the head of the counterparty.

- Information about the purchased product or service: cost, date of purchase, additional information (for example, when returning goods under warranty, the warranty period of the product is additionally indicated).

- The claim as such (for example, listing the defects of the goods).

- Claims made: exchange, refund, reimbursement of costs, etc.

- Information about providing copies of documents in the application (for example, a copy of a receipt, warranty card, etc.).

- Date, position, signature and transcript of the applicant's signature.

You can learn more about filing claims in 1C software products from the video

Debit 51 Credit 91.1 RUB 750,000 - compensation received.

Such operations make it possible to fix the loss of the Oasis enterprise on the accounts “Other income and expenses”, which arose from the assignment of the right to claim.

Accountants of the Iceberg company must make a debit entry to account 76.3 in order to fix the debt from counterparties.

The difference between the rights received and the costs for them is shown on the credit of accounts 98/1, 83 or 90/1.

Debit RUB 51,900,000

Debit 98.1 RUB 765,000

Account credit 76 RUB 1,350,000

Debit 98.1 Credit 91.1 RUB 150,000

The real amount of profit from the operation is reflected in account 98/1, intended for fixing deferred income.

Account 76.AB allows you to summarize information on calculations for the payment of VAT from advance payments. Accounting is maintained with those customers and buyers from whom money was received in advance for the planned shipment of goods or for the provision of various types of services.

Business operations may vary. For example: D68.02 K76.AB - accounting for value added tax on payment received from the client in advance. D 76.

AB has the following subconto (analytical characteristics): “Counterparties”, “Invoices”.

The account in question (76) in debit can correspond with the following: “Fixed assets” (01), “Equipment for installation” (07), “Profitable investments in the MC” (03), “Investments in non-current assets” (08), “ Intangible assets” (04). From the second section of the chart of accounts, it interacts with the items "Materials" (10), "Animals for rearing and fattening" (11), "Procurement and acquisition of MC".

A claim may contain one or more claims. For example, these could be requirements:

- pay sanctions for violation of the terms of the contract (Article 329 of the Civil Code of the Russian Federation);

- to pay damages. For example, related to the forced purchase of goods from another supplier at a higher price (Article 393 of the Civil Code of the Russian Federation);

- return the paid, but not worked out advance payment (Article 453 of the Civil Code of the Russian Federation);

- issue a refund or replacement of products (goods). For example, if it is defective (Article 475 of the Civil Code of the Russian Federation);

- eliminate defects. For example, to correct the quality of improperly performed work (clause 1 of article 723 of the Civil Code of the Russian Federation);

- to reduce the price, that is, to mark down the object of the contract. For example, if a product of inadequate quality was received (clause 1 of article 475 of the Civil Code of the Russian Federation).

Actions of the counterparty upon receipt of a claim

The counterparty to which the organization has filed a claim has the right to:

- refuse recognition (for example, in the absence of his guilt in violation of the obligation);

- continue business correspondence (for example, in order to obtain additional information or prove the absence of guilt in breach of obligation).

This follows from Article 401 of the Civil Code of the Russian Federation.

In the last two cases (refusal and continuation of correspondence), no records need to be made in accounting (Article 5 of the Law of December 6, 2011 No. 402-FZ). Claims not recognized by the debtor also do not affect taxation (Chapters 25, 26.2 and 26.3 of the Tax Code of the Russian Federation). This is due to the fact that in this case neither an obligation arises nor any settlements occur.

Situation: will the court accept the organization's statement of claim against its counterparty for consideration if the counterparty left the claim previously sent to it without consideration?

Yes, accept.

In order for the court to consider the claim against the counterparty, the very fact of pre-trial (claim) proceedings between the parties is important, and not its result. Therefore, if the counterparty did not consider the claim received, did not respond to the organization, or during the proceedings the parties did not come to an agreement, the courts consider the pre-trial (claim) procedure for resolving disputes to be observed (see

In the event that the debtor recognizes a claim made by an organization, the accounting and taxation of such a transaction depends on the nature of the claims presented to the counterparty.

Settlements for claims recognized by counterparties, in most cases, conduct using account 76 of sub-account 2 “Calculations on claims” (Instructions for the chart of accounts).

Recognition of a claim

Legislation or an agreement may provide, for example, such types of sanctions for breach of obligations: forfeit (fines, penalties), interest for late payment, etc. This follows from Articles 329 and 395 of the Civil Code of the Russian Federation.

In addition, the organization may demand that the perpetrator compensate for losses associated with the violation of contractual obligations, including lost profits (Article 15 of the Civil Code of the Russian Federation). For example, if the contract of sale is terminated through the fault of the seller, the buyer has the right to apply the norms of Article 524 of the Civil Code of the Russian Federation.

Namely, to demand that the counterparty compensate him for the losses incurred due to the need to purchase goods from another seller at a higher price. If a new contract is concluded within a reasonable time and at a reasonable price, the failed seller must compensate the buyer for the difference between the value of the goods under the terms of the terminated and the new contract.

How to reflect in accounting and taxation the amount of forfeit (fine, penalty) issued by the organization and recognized by the debtor, see How to take into account the receipt of legal interest, penalties and interest for delay in fulfilling obligations. Similarly, reflect the reimbursement of the counterparty for losses.

An example of reflection in accounting and taxation of the receipt of a penalty from a counterparty for violation of the terms of the contract. The organization applies the general system of taxation

In February, OOO Torgovaya Firma Germes supplied OOO Alfa with goods worth 120,000 rubles. (including VAT - 18,305 rubles). Their due date under the contract is February 21.

In case of late payment for the delivered goods, the buyer, according to the terms of the contract, must pay a penalty. The amount of the penalty is 0.1 percent of the amount of debt for payment for goods for each day of delay.

Alfa transferred payment for the delivered goods to Hermes only on March 24. On March 25, Hermes filed a claim against Alfa for payment of a penalty for late payment under the contract (the delay was 31 days).

The amount of the penalty for late payment for the goods amounted to: 120,000 rubles. × 0.1% × 31 days = 3720 rubles.

"Alpha" recognized the claim of "Hermes" and paid a penalty.

Debit 76-2 Credit 91-1– 3720 rubles. - a penalty is charged for violation of the deadline for payment for the goods;

Debit 51 Credit 76-2– 3720 rubles. - received a penalty.

Hermes pays income tax on a monthly basis, using the accrual method. The accountant included the amount of the penalty (3720 rubles) in the non-operating income of the organization.

Markdown of goods

The organization has the right to demand the return of the advance (part of the advance) under the contract if the obligations under it have not been fulfilled (Article 453 of the Civil Code of the Russian Federation). For example, if the supplier did not transfer the goods within the period specified by the contract, you can demand a refund of the amount paid for the delivery (clause 1, article 463 of the Civil Code of the Russian Federation). After canceling obligations under the contract or changing them, submit a claim to the partner.

From this moment, the amount of the prepayment transferred to the supplier (executor) is not an advance payment. It becomes the debt of the supplier (executor) for the return of money. The procedure for reflecting such debts in accounting is not provided by law. This means that the organization must install it on its own and fix it in the accounting policy for accounting purposes.

Debit 76-2 (60) Credit 60 (76) - reflects the debt of the counterparty on the claim (based on the agreement of the parties).

For organizations that apply the general taxation regime, such an operation will affect the calculation of taxes as follows.

When calculating income tax (both the accrual method and the cash method), the amount of the advance payment returned by the counterparty will not affect the tax base (Articles 41, 249–251, clause 1 of Article 272, clause 2 of Article 273 of the Tax Code of the Russian Federation).

However, such a transaction will have an impact on VAT calculations. In the quarter in which the advance was returned to the partner, restore the previously deductible VAT (Subclause 3, Clause 3, Article 170 of the Tax Code of the Russian Federation).

For more information, see How to recover input VAT.

An example of the reflection in accounting of operations for the return of an unworked advance payment by a supplier. The organization applies the general system of taxation

On September 20 (III quarter), Alpha LLC transferred a 100% prepayment to Trade Firm Germes LLC under the agreement dated September 1. The contract provides for the supply of a consignment of goods to Alfa in the amount of 590,000 rubles. (including VAT - 90,000 rubles) in October (IV quarter).

To account for settlements with the supplier, the accountant uses sub-accounts opened to account 60 (sub-account "Advances issued") and to account 76 (sub-account "VAT settlements from advances issued").

Debit 60 subaccount "Calculations on advances issued" Credit 51–590,000 rubles. - an advance payment was transferred on account of the forthcoming shipment of goods;

Debit 68 subaccount “VAT settlements” Credit 76 subaccount “VAT settlements from advances issued” - 90,000 rubles. - accepted for deduction of VAT paid to the supplier as part of the advance payment.

By the deadline set in the contract, Hermes did not have time to purchase the required amount of products and did not deliver. On November 21, Alfa filed a claim against Hermes for violation of the term for fulfilling the contract with a request to terminate it.

On November 22, the contract between Hermes and Alpha was terminated. On the same day, Hermes returned to Alfa the advance payment received in the amount of 590,000 rubles. (including VAT - 90,000 rubles).

Debit 76-2 Credit 60 sub-account "Calculations on advances issued" - 590,000 rubles. - the supplier's debt is reflected in the advance payment amount subject to return due to termination of the contract for the submitted claim;

Debit 51 Credit 76-2– 590,000 rubles. – the unworked advance payment is returned by the supplier;

Debit 76 subaccount "VAT settlements from advances issued" Credit 68 subaccount "VAT settlements" - 90,000 rubles. - VAT, previously accepted for deduction, was restored.

Simplified organizations do not take into account the amount of the advance returned by the counterparty when calculating the single tax. For more information on this, see What kind of income you need to pay a single tax on simplification.

When calculating UTII, the returned advance does not affect the calculation of tax (Article 346.29 of the Tax Code of the Russian Federation).

In accounting and taxation, a claim with a requirement to take back the goods is considered recognized after the return has been made (Article 5, paragraph 1 of Article 9, paragraph 1 of Article 10 of the Law of December 6, 2011 No. 402-FZ and Chapter 25, 26.2 and 26.3 of the Tax Code of the Russian Federation).

How can the buyer record the return of goods on the grounds provided for in the legislation;

How can the buyer take into account the return of goods on the grounds provided for by the agreement.

If the counterparty is required to replace the returned goods, then in accounting and taxation reflect the satisfaction of such a claim in two operations: the return of some goods and the acquisition of others.

The organization has the right to demand from the counterparty to reduce the price of defective goods or poor-quality work (see, for example, Articles 475, 723 of the Civil Code of the Russian Federation). A product (work) with a defect cannot cost as much as a quality product (work).

Reflect the markdown of the goods by analogy with the discount received from the counterparty.

For more information about accounting and taxation of such an operation, see How to record discounts and bonuses from a supplier when purchasing goods (works, services).

Fixing a marriage

If the organization received a defective product, it has the right to demand that the defect be eliminated free of charge (Article 475 of the Civil Code of the Russian Federation). A similar rule applies in case of poor-quality performance of work (see, for example, Article 723 of the Civil Code of the Russian Federation).

Warranty repair (warranty service) can be carried out by:

- manufacturers of products (works, services) (clause 6, article 5 of the Law of February 7, 1992 No. 2300-1);

- trade organizations (including importers) (clause 7, article 5 of the Law of February 7, 1992 No. 2300-1).

Warranty repairs (warranty service) are subject to goods (results of work) in respect of which the warranty period is established. The start date of the warranty period is the date of transfer of goods (results of work performed) to the buyer (customer). That is, the date of registration of shipping documents or the act of acceptance of work performed. This procedure follows from the provisions of Articles 470, 471 of the Civil Code of the Russian Federation, paragraph 2 of Article 19 of the Law of February 7, 1991 No. 2300-1.

To account for goods returned to correct the marriage, you can open a sub-account "Property for warranty service" to account 41 (08, 01, 10). A unified form of the primary document, by which the parties could issue the acceptance and transfer of goods for warranty service, is not provided for by law.

Input VAT on acquired material assets can be deducted in the general manner (clause 1, article 172, clause 2, article 171 of the Tax Code of the Russian Federation).

The tax base for income tax will not be reduced by the value of inventory items acquired and transferred for warranty service.

This is due to the fact that both with the cash method and with the accrual method, one of the conditions for writing off the cost of purchased goods as expenses is their sale (paragraph 1 of article 272, paragraph 3 of article 273, subparagraph 3 of paragraph 1 of art. 268, article 320 of the Tax Code of the Russian Federation). The goods transferred to correct the marriage cannot be sold to end consumers, which means that its cost cannot be written off (Articles 470, 471 of the Civil Code of the Russian Federation).

Prior to being written off to production (operation), it will not be possible to take into account when calculating income tax and materials transferred to the counterparty for the correction of defects (clause 2 of article 272, subclause 1 of clause 3 of article 273, clause 1 of article 254, subclause 1 paragraph 3 of article 273 of the Tax Code of the Russian Federation). As well as expenses for the acquisition of fixed assets (depreciation deductions) that were not put into operation due to an identified defect (clause 3 of article 272, subclause 2 of clause 3 of article 273, clause 4 of article 259 of the Tax Code of the Russian Federation) .

Similar rules apply to the calculation of a single tax when simplified from the difference between income and expenses (with the exception of the provisions on VAT) (subparagraphs 1, 5, 23, paragraph 1, article 346.16, subparagraphs 1, 2, 4, paragraph 2, art. 346.17 of the Tax Code of the Russian Federation). The input tax on the value of acquired valuables cannot be deducted (clause 2 of article 346.11, clause 2 of article 171 of the Tax Code of the Russian Federation).

The operation to transfer goods to correct the marriage will not affect the amount of UTII (Article 346.29 of the Tax Code of the Russian Federation).

Independent elimination of defects in purchased goods should be reflected in the same way as losses from internal marriage.