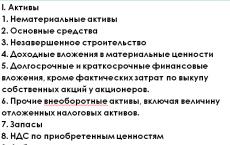

Claim from the buyer of the wiring. Postings on claims from buyers Sub-account settlements on claims

Home — Articles

Settlements on claims arise between the parties to business contracts in connection with non-compliance with the terms of these contracts, for example, when materials and goods are not delivered, when materials of lower quality are supplied, when the procedure for settlements with counterparties is violated, etc.

These calculations can be carried out both in court and in pre-trial (claim) procedures. The claim procedure is the least expensive, so it is important for organizations to properly organize and use the work on the timely filing of claims.

The current Federal Law of 05.05.1995 N 71-FZ "On the Enactment of the Arbitration Procedure Code of the Russian Federation" provides for the settlement of disputes out of court in relations with transport organizations and communication organizations on the basis of the relevant Codes.

Currently, the most detailed regulation of the procedure for conducting claims work in the carriage of goods by rail. This procedure is determined by the Federal Law of July 19, 2011 N 248-FZ "On Amendments to Certain Legislative Acts of the Russian Federation in Connection with the Implementation of the Provisions of the Federal Law "On Technical Regulation".

The submitted claim must be considered by the carrier within 30 days, including the written notification of the applicant about the results of the consideration of the claim. The notice must necessarily indicate the grounds for rejecting the claim with reference to the relevant article of the Charter of the Railway Transport of the Russian Federation.

Claims for loss, shortage, damage to goods are presented for each shipment issued by a railway bill of lading. For goods of the same name, loaded at one station, by one consignor to the address of one consignee, it is allowed to send one claim for the number of wagons specified in the commercial act.

For legal entities, the claim must include:

- the name of the claimant and data on state registration as a legal entity;

— location of the legal entity (republic, territory, region, city, house number, building, apartment);

- bank details (number of the current account in a credit institution, to which the amount of the claim should be received);

– grounds for filing a claim (complete or partial loss of cargo, shortage, delay in delivery, etc.);

- the amount of the claim for each individual claim, for each waybill, for each receipt of cargo acceptance and other documents;

- a list of documents attached to the claim.

The claim must include the following information:

- the request of the applicant;

- the amount of the claim;

— a reasonable calculation of the amount of the claim, if it is subject to monetary value;

— list of attached documents and other evidence;

— other information necessary to resolve the dispute.

The answer to the claim is given in writing and signed by the head and chief accountant. The answer states:

- recognized amount;

- the number and date of the payment order for the transfer of this amount;

- the term and method of satisfying the claim, if it does not have a monetary value.

In case of refusal to satisfy the claim (full or partial), a reference to the relevant legal norms and evidence is required to justify the refusal and a list of relevant attached documents.

It should be noted that for the claim to be reflected in the accounting of the applicant, two conditions must be met:

1) either recognition of the claim by the other party to the contract;

2) or the presence of a court decision.

The answer to the claim is sent by registered or valuable mail, by telegraph, teletype, or handed over against receipt.

Reflection in accounting operations related to settlements on claims is carried out in accordance with the current Chart of Accounts, Accounting Regulations "Income of organizations" PBU 9/99, "Expenses of organizations" PBU 10/99, "Accounting for inventories "PBU 5/01, as well as the Guidelines for the accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 N 119n (hereinafter - the Guidelines).

In accordance with clause 58 of the Guidelines, accounting for shortages and damage to inventories (IPZ) is carried out as follows:

1) the amount of shortages and damage within the limits of natural wastage is calculated by multiplying the amount of missing (spoiled) materials by the contractual (sales) price of the supplier. At the same time, transportation costs and value added tax (VAT) related to shortages and damage are not taken into account. Account 60 "Settlements with suppliers and contractors" is debited for the amount of shortages. At the same time, the amount of shortages (damage) is written off to the account of deviations.

The sequence of entries in the accounts of accounting is drawn up as follows:

- Dt c. 10 (15) Set of accounts 60 - for the amount of the cost of actually received materials;

- Dt c. 94 Set of accounts 60 - for the amount of the cost of missing (spoiled) materials;

- Dt c. 10 (15) Set of accounts 94 - for the amount of missing (spoiled) materials within the norms of natural loss.

The amount of VAT paid upon the acquisition of the inventory is not reversed, since settlements with the supplier in terms of VAT are not subject to adjustment and no damage to the budget is caused.

However, if the damaged materials can be used in the organization or sold at a markdown, then they are accounted for at the prices of the possible sale, and the amount of losses from damage is reduced by this amount. In other words, for the amount of the cost of inventories, capitalized at the price of a possible sale, account 10 is debited and account 94 is credited;

2) the amount of shortages and damage to materials in excess of the norms of natural wastage is taken into account at the actual cost, which includes:

a) the cost of missing (spoiled) materials, calculated as the product of their quantity at the contractual (sales) price of the supplier (excluding VAT). If damaged materials can be sold at a discount, then they are accounted for at the prices of their possible sale with a decrease in the amount of losses from damage to materials;

b) the amount of deviations (transport and procurement costs) payable by the buyer in the part related to missing (damaged) materials. The specified amount is determined by multiplying the cost of missing (damaged) materials by the percentage of deviations to the total cost of materials by the percentage of deviations to any total cost of materials (at the supplier's selling prices) for this delivery (excluding VAT). The well-known formula for calculating the absolute amount and the average percentage of deviations is used;

c) the amount of VAT related to the cost of shortage and damage to materials, and the amount of VAT related to deviations (transport and procurement costs) associated with their acquisition.

The scheme of accounting entries is as follows:

- Dt c. 10 (15) Set of accounts 60 - for the amount of the cost of inventory under the supply contract;

- Dt c. 19, subaccount 3, set of sc. 60 - for the amount of VAT on the cost of acquired reserves;

- Dt c.

94 Set of accounts 10 - for the amount of the value of the missing reserves;

- Dt c. 94 Set of accounts 19 - for the amount of VAT on the cost of missing stocks;

- Dt c. 76, sub-account 2 "Calculations on claims", Kt sc. 94 - for the amount of the cost of stocks (excluding VAT), for which a claim has been made to the transport organization.

The above scheme of accounting entries should be used regardless of the actual payment for the purchased materials.

Example 1

The Alpha organization paid for materials in the amount of 120,000 rubles, including VAT - 18,305 rubles. In fact, upon acceptance, the delivery amount turned out to be 108,200 rubles. The carrier recognized the amount of the claim.

The following entries are made in the accounting records:

- Dt c. 10 Set of accounts 60 - 100,000 rubles;

- Dt c. 19 Set of sc. 60 - 18,000 rubles. - on the amount of accent of the supplier's settlement documents;

- Dt c. 60 Set of accounts 51 - 120,000 rubles. - on the amount of payment;

- Dt c. 94 Set of accounts 10 - upon admission, a shortage of materials in the amount of 10,000 rubles was revealed. without VAT;

- Dt c. 94 Set of accounts 19 - for the amount of VAT on the cost of missing materials - 1800 rubles;

- Dt c. 76, sub-account 2 "Calculations on claims", Kt sc. 94 - for the amount of shortage on the claim made to the carrier - 11,800 rubles.

In economic practice, the situation is quite common when, under the terms of supply contracts, the ownership of the inventory passes to the buyer only after the stock arrives at the destination station or at the buyer's warehouse.

Supplier accounting records the following:

- Dt c. 62 Set of sc. 90, sub-account 1 "Revenue", - in the amount of the cost of shipped stocks;

- Dt c. 90, subaccount 2 "Cost of sales", Kt sc. 40 (43) - for the amount of the actual cost of shipped stocks;

- Dt c. 90, sub-account 3 "Value Added Tax", Kt sc. 68, sub-account "Value Added Tax", - for the amount of VAT on the cost of shipped goods;

- Dt c. 94 Set of accounts

62 - for the amount of shortage of stocks identified during their acceptance at the destination station (at contractual prices, including VAT);

- Dt c. 94 Set of accounts 9, subaccount 1 "Revenue";

- Dt c. 76, sub-account 2 "Calculations on claims", Kt sc. 94 - for the amount of the claim against the carrier.

Example 2

Firm "Alpha" shipped lumber, the actual cost of which is 90,000 rubles.

The contractual cost of delivery is 120,000 rubles, including VAT - 18,305 rubles. When accepting cargo at the destination station, sawn timber was accepted in the amount of 108,200 rubles. (in view of VAT).

The following entries were made in the accounting records of Alpha:

- Dt c. 90, subaccount 2 "Cost of sales", Kt sc. 43 - for the amount of the actual cost of delivered lumber - 90,000 rubles;

- Dt c. 90, sub-account 3 "Value Added Tax", Kt sc. 68 - for the amount of VAT on the cost of shipped lumber - 18,305 rubles;

- Dt c. 62 Set of sc. 90, subaccount 1 "Revenue", - for the amount of the contractual value of the shipped materials - 120,000 rubles;

- Dt c. 94 Set of accounts 62 - for the amount of the shortage revealed during the acceptance of cargo at the destination station, at contractual prices, including VAT - 11,800 rubles;

- Dt c. 94 Set of accounts 19, sub-account 1 "Revenue", - for the amount of the cost of the shortage of lumber at contractual prices, including VAT - 11,800 rubles;

- Dt c. 76, sub-account 2 "Calculations on claims", Kt sc. 94 - for the amount of the claim declared to the carrier - 11,800 rubles.

It should be noted that the amounts of fines by the consignor or consignee to the carrier are recorded separately. Regardless of who claimed the claim (the consignor or the consignee), in the accounting records of the applicant, these amounts are shown as other income, i.e. on the debit of account 76, subaccount 2 "Calculations on claims", and on the credit of account 91, subaccount 1 "Other income". These amounts must be recognized by the carrier (payer) or awarded by the court. Otherwise, they cannot be taken into account and included in gross and taxable profit. However, the amounts of fines, penalties and forfeits are paid in excess of the amount of losses incurred and are not interconnected, although they are ultimately reflected in account 91 "Other income and expenses".

Consideration of the issue of accounting for claims between participants in economic contracts plays an important role in regulating the supply of materials, goods in terms of quality, timing, and ultimately in meeting the deadlines for the production of works and services.

May 2012

If you made a claim to your supplier (contractor, carrier), then no postings need to be made until (clause 16 PBU 9/99):

- or the supplier does not recognize your claim (for example, you will receive a letter agreeing to compensate for the damage that was caused to your organization, signed by the head of the supplier organization);

- or the court decision on the recovery of the amount of damage caused to you from the counterparty will not come into force.

On the date when any of these events occurred, the accounting should reflect the supplier's debt to you on the debit of sub-account 76-2 “Calculations on claims”. With which account the subaccount 76-2 on the loan will correspond, depends on the reason for the claim. The most common situations are shown in the table.

| Reason for making a claim | Wiring |

| As a result of an error, the supplier has overpriced in the shipping documents, and you have taken into account the goods at an overpriced price | D 76-2 - K 10 (41) |

| You paid for the goods in advance, the supplier, as a result of an error, overestimated the price in the shipping documents, but you accepted the goods for accounting at the price established by the contract | D 76-2 - K 60 |

| Due to the fault of the supplier (for example, in connection with the supply of low-quality raw materials), you produced defective products | D 76-2 - K 28 |

| The goods disappeared due to the fault of the transport company (carrier) | D 76-2 - K 60 |

| The supplier who violated the contract must compensate for the losses, pay a fine or forfeit | D 76-2 - K 91-1 |

On the credit of subaccount 76-2, the amounts received from the supplier are reflected in the posting:

If your buyers (customers) filed a claim with your organization, then, until the management recognizes it, no postings need to be made. On the date of recognition of the claim, reflect the compensation for damage to the counterparty.

Tags: Accounting

This is due to the fact that both with the cash method and with the accrual method, one of the conditions for writing off the cost of purchased goods as expenses is their sale (paragraph 1 of article 272, paragraph 3 of article 273, subparagraph 3 of paragraph 1 of art. 268, article 320 of the Tax Code of the Russian Federation). The goods transferred to correct the marriage cannot be sold to end consumers, which means that its cost cannot be written off (Articles 470, 471 of the Civil Code of the Russian Federation). Prior to being written off to production (operation), it will not be possible to take into account when calculating income tax and materials transferred to the counterparty for the correction of defects (clause 2 of article 272, subclause 1 of clause 3 of article 273, clause 1 of article 254, subclause 1 paragraph 3 of article 273 of the Tax Code of the Russian Federation). As well as expenses for the acquisition of fixed assets (depreciation deductions) that were not put into operation due to an identified defect (clause 3 of article 272, subclause 2 of clause 3 of article 273, clause 4 of article 259 of the Tax Code of the Russian Federation) .

Settlement of claims: postings in accounting

In case of refusal, a reference to the legislation is indicated in the letter. If the supplier refuses to satisfy the claim, the purchasing organization has the right to go to court. Accounting for claims from the buyer After considering the buyer's claim, the supplier can either decide to satisfy it or refuse.

LLC "Orchid" received from the supplier materials in the amount of 20,000 rubles. When checking, a shortage of 4,000 rubles was found. The organization filed a claim with the supplier.

Account 76.2 accounting of settlements on claims. example, wiring

Debit account Credit account Posting description 76.02 20 Claim for downtime or defect due to the fault of the contractor in the main production is recognized 76.02 23 Claim for downtime or defect due to the fault of the contractor in auxiliary productions is recognized 76.02 29 Claim for downtime or defect due to the fault of the contractor in service facilities is recognized 76.02 28 A claim for the supply of low-quality materials that caused defective products was recognized 76.02 41 A claim was recognized for identified errors in the delivered goods after they were accepted into the inventory warehouse 76.02 51 (52) A claim was recognized against credit organizations for amounts of money erroneously transferred or erroneously debited from the organization's current account 76.02 60 Recognized claim for identified errors on the delivered goods after before acceptance to the warehouse of goods and materials 76.02 91 Reflected recognized by the payer (or awarded by the court) fines, penalties, etc.

Reflection of a claim in accounting: postings

Form and content of the claim Submit the claim in writing in any form.

At the same time, clearly indicate what obligations the counterparty did not fulfill, the provisions of which document were violated (protocol, contract, agreement, etc.), offer your way out of the current conflict situation. Attention: if the organization decides to file a claim with the counterparty, notify him in a timely manner that a violation of the terms of the contract has been identified.

Otherwise, he may refuse to satisfy the claim (see, for example, Article 483 of the Civil Code of the Russian Federation). If the organization decides not to file a claim, but immediately goes to court, its claim will not be considered. It is impossible to go to court without going through the stage of pre-trial resolution of disputes (for example, immediately write a statement of claim for the recovery of a penalty).

This follows from Article 128 of the Arbitration Procedure Code of the Russian Federation and Article 136 of the Civil Procedure Code of the Russian Federation.

Claims Settlement - Postings

VAT paid to the supplier as part of the advance payment. By the deadline set in the contract, Hermes did not have time to purchase the required amount of products and did not deliver. On November 21, Alfa filed a claim against Hermes for violation of the term for fulfilling the contract with a request to terminate it. On November 22, the contract between Hermes and Alpha was terminated. On the same day, Hermes returned to Alfa the advance payment received in the amount of 590,000 rubles. (including VAT - 90,000 rubles). The following entries were made in Alpha's accounting: Debit 76-2 Credit 60 sub-account "Calculations on advances issued" - 590,000 rubles.

- the supplier's debt is reflected in the advance payment amount subject to return due to termination of the contract for the submitted claim; Debit 51 Credit 76-2– 590,000 rubles. – the unworked advance payment is returned by the supplier; Debit 76 subaccount "VAT settlements from advances issued" Credit 68 subaccount "VAT settlements" - 90,000 rubles.

Reflection of settlements on claims in accounting

Accounting for claims from the supplier If the buyer returns the goods that have already been credited at home, then, according to the Ministry of Finance and the Federal Tax Service, this operation refers to reverse sale. The reason for returning the item is irrelevant. In this operation, the buyer is obliged to issue an SF on the returned goods. The buyer may submit the following requirements:

- return of advance payment for unfulfilled obligations;

- issue a replacement or return of marriage;

- eliminate defects;

- reduce the price of the contract;

- pay fines or penalties.

Upon receipt of a claim, the seller organization has the right to both recognize it and refuse to recognize it.

Unrecognized claims do not affect the calculation of income tax. If a claim is recognized, its accounting depends on the nature of the claim.

Accounting for settlements on claims on account 76.2 (with examples)

Depreciation groups: fixed asset classification updated The Government of the Russian Federation has corrected the classifier of fixed assets by depreciation groups. The amendments come into force retroactively - from 01/01/2018.< … Выдать увольняющемуся работнику копию СЗВ-М нельзя Согласно закону о персучете работодатель при увольнении сотрудника обязан выдать ему копии персонифицированных отчетов (в частности, СЗВ-М и СЗВ-СТАЖ).

However, these reporting forms are list-based, i.e. contains information about all employees. This means that the transfer of a copy of such a report to one employee is the disclosure of personal data of other employees.< … Компенсация за неиспользованный отпуск: десять с половиной месяцев идут за год При увольнении сотрудника, проработавшего в организации 11 месяцев, компенсацию за неиспользованный отпуск ему нужно выплатить как за полный рабочий год (п.28 Правил, утв.

NCT USSR 04/30/1930 No. 169).

Accounting entries for accounting for settlements on claims

As a result of the investigation conducted by the “Seller”, it was reliably proved that the driver Ivanov stole the missing brick for personal needs. The organization ordered Ivanov (in writing) to compensate for his cost. In the accounting of the "Seller" this was reflected in the postings: DEBIT 73-2 CREDIT 94 - 9000 rubles - the amount of damage was attributed to Ivanov; DEBIT 70 CREDIT 73-2 - 9000 rubles - the amount of the shortfall was withheld from Ivanov's salary.

Claim work can be started as a result of a violation by one of the parties of the terms of cooperation, if there are shortages in the delivered batch of products, if there are counting errors in the received accounting documents. Oral claims are not legally binding. To obtain clarification from the counterparty and correct the error, it is necessary to send a written claim to his address.

Reflection of a claim in accounting: postings with the buyer

In accounting, claims made to suppliers are displayed on account 76.2. Account analytics is conducted in the context of each completed claim. The buyer, if there are grounds for a dispute with the counterparty, draws up a claim letter. The supplier must respond to the customer's claims - agree with the buyer's opinion and fulfill the contractual terms in full, or refuse to fulfill it. In the latter case, the buyer has the right to file a lawsuit.

When a marriage is detected, a claim is reflected in accounting (postings) by debiting account 76.2 with simultaneous crediting of one of the cost accounts ( , , ), if prices do not meet the conditions of standards, counting errors, etc. credit score 60 . If the supplier considers the customer's requirements reasonable, he satisfies them. In the accounting of the buyer, receivables in the form of a claim are repaid when posting a credit turnover according to 76.2.

Example

LLC "Expert" ordered material assets from LLC "Korund" on a prepaid basis. The amount of the transaction is 2575 rubles. At the time of shipment, a shortage of 575 rubles was revealed. The buyer filed a claim, the entries in the accounting reflected the amount of the shortage as the debt of the counterparty. The supplier satisfied the customer's requirements by returning the shortfall amount. Later, a shortage of purchased valuables from another supplier, Orient LLC, in the amount of 700 rubles was discovered, the counterparty refused to satisfy the claim.

Correspondence in the account:

- D60 - K51 - 2575 rubles, payment for goods and materials of Korund LLC

- D10 - K60 - 2000 rubles. (2575 - 575), posting of actually received valuables;

- D76.2 - K60 - 575 rubles, a claim has been made, postings are formed according to the analytical sub-account of Korund LLC;

- D51 - K76.2 - 575 rubles, the claim was satisfied by the supplier.

- D 76.2 - K60 - 700 rubles, the claim was sent to Orient LLC;

- D94 - K76.2 - 700 rubles, Orient LLC does not recognize the mistake, compensation for the shortage will not be made, the amount is written off as expenses.

Postings on claims from buyers: accounting with the supplier

Upon receipt of a claim from the buyer, the supplier can take one of the following decisions:

- return the amount received from the counterparty (in part or in full, depending on the type of violation);

- replace defective products;

- take back non-working equipment

- eliminate defects;

- adjust the contractual prices in the direction of their reduction;

- charge and pay a penalty or penalty.

If the supplier agrees with the content of the claim letter, is ready to accept defective products and reimburse their cost, such a return procedure will be carried out as a reversal sale.

Example

Sharm LLC sold inventory items in the amount of 5,800 rubles, including VAT of 1,044 rubles. The buyer's payment for the product is overdue by 3 days. Under the terms of the contract, a penalty is charged for late payment. The amount of the penalty rate is 0.09% per day.

Supplier postings:

- D76.2 - K91.1 - a penalty in the amount of 18.48 rubles was recognized. (6,844 x 0.09% x 3).;

- D51 - K76.2 - the buyer satisfied the requirements for the claim letter, the penalty was paid in the amount of 18.48 rubles.

If the buyer transferred the payment for the products in advance, and the supplier delayed the delivery, then there would be grounds for conducting claims work. Postings on claims from buyers look like the supplier:

- D51 - K62 - prepayment received;

- D62 - K76.2 - the requirements for the claim are taken into account and the company's debt to the client is reflected;

- D76.2 - K51 - satisfaction of the requirements of the buyer.

The claim to the supplier is a document containing information in the form of a claim from the buyer to the supplier regarding the discrepancy between the quality and quantity of the goods, inadequate delivery conditions and other discrepancies related to the fulfillment of the terms of the contract.

The claim is necessary to resolve disputes before litigation.

When concluding a supply contract, the parties stipulate various situations that may arise during the implementation of the contract. Despite all the conditions, in practice situations often arise when the supplier does not fulfill its obligations, or fulfills them, but not in full. In the event of such situations, the buyer has the right to file a claim with the supplier to protect his interests.

The resolution of disputes by filing a claim should be stipulated in the contract in a separate paragraph. This will simplify the mutual understanding of the parties, save their time and money, rather than resolving such situations in court.

How to write a complaint to a supplier?

The claim is made in writing. The oral form is not allowed. The legislation does not provide for a specific procedure for drawing up a claim, as a result of which the claim is drawn up in an arbitrary form.

What to include in a claim?

The claim to the supplier must contain the following information:

1. The very fact of disagreement, i.e. wording of the claim.

2. The claim must be made in a certain amount (fine or penalties).

3. The basis of the claim with reference to supporting documents (non-compliance of the quality of the goods with certificates, non-compliance of the quantity of goods (services) in the invoice (TTN, certificate of completion, etc.) and other documents confirming non-compliance with the terms of the contract).

4. List of documents confirming the expediency of filing a claim.

5. The claim must indicate the period during which the supplier is obliged to investigate this situation and take the necessary measures to eliminate the violations.

The Supplier shall, within the period specified by the Buyer, make its decision on the submitted claim. In case of violation of the terms, the buyer has the right to file a claim with the Arbitration Court.

With the correct organization of the company's activities, all claims are taken into account in the journal, which contains information about claims made against the supplier, statements of claim and facts of disagreement.

How to reflect claims settlements in accounting?

Accounting records of settlements on claims to the supplier are kept on account 76, sub-account 2 “Settlements on claims”.

The company has the right to make a claim to the supplier:

If the supplier fails to comply with the terms of the contract;

- in case of shortage of goods and materials;

- if arithmetic errors are found in the documents for goods (services, works) received from the supplier.

1. In case of non-compliance with the terms of the contract, sanctions are usually applied to the supplier: fines, penalties, forfeits. Based on paragraph 3 of Art. 250 of the Tax Code, such income (from receiving penalties, fines, forfeits) is recognized as non-operating and is reflected in the following entry:

Dt 76-2 Kt 91-1 - accrual of penalties, fines, forfeits recognized by the supplier or awarded in court.

2. Upon acceptance of the goods, a shortage or damage to valuables may be detected. Then the following entries will be made in accounting.

Dt 94 Kt 60 - accounting for shortages (damage to goods and materials) within the limits under the terms of the contract

Dt 76-2 Kt 60 - accounting for shortages (damage to goods and materials) in excess of the amounts under the terms of the contract

3. If the court refused to satisfy the buyer's claim, the write-off is made as follows.

Dt 94 Kt 76-2 - writing off shortages in excess of amounts under the terms of the contract

4. If the court found the claim justified and decided to recover the shortage from the supplier, then the sale of goods and materials is reversed

Dt 62 Kt 90-1 reversal - the sale of the missing goods and materials was written off;

Dt 90-2 Kt 41 (43) reversal - written off the cost of the missing goods and materials;

Dt 90-3 Kt 68 reversed - VAT on sold missing goods and materials reversed;

Dt 62 Kt 76-2 - the amount of the claim is taken into account

Dt 76-2 Kt 51 (50, 52) - the amount of the claim has been repaid

Dt 94 Kt 41 (43) - writing off the missing goods and materials.

Example and posting of claims to the supplier.

Vasilek LLC (buyer) entered into an agreement with Gvozdika LLC (seller) for the supply of 1,200 roses for 72,000 rubles, including VAT - 10,983.05 rubles. When unloading the goods, it turned out that only 1,100 pieces worth 66,000 rubles were actually received, including VAT - 10,067.80 rubles.

The cost of 1 rose from Gvozdika LLC is 45 rubles. VAT is charged "on shipment".

Entries in the accounting records of Gvozdika LLC:

Dt 51 Kt 62 = 72,000 rubles - receiving an advance for roses

Dt 62 Kt 90-1 = 72,000 rubles. - reflected the sale of roses (base - invoice)

Dt 90-2 Kt 41 \u003d 54,000 rubles (45 rubles x 1,200 pieces) - the cost of roses was written off;

Dt 90-3 Kt 68 = 10983.05 rubles. - VAT charged on sales.

Entries in the accounting of Vasilek LLC:

Dt 60 Kt 51 = 72,000 rubles. – the supplier received an advance payment for roses

Dt 10 Kt 60 = 55,932.20 rubles - roses purchased after the fact

Dt 19 Kt 60 = 10067, 80 rubles - input VAT on purchased roses

LLC "Vasilek" drew up an act of shortage and submitted a claim to LLC "Gvozdika" in the amount of 6,000 rubles. Gvozdika LLC accepted the claim and admitted his guilt, returning the money to the buyer.

Accounting records of Vasilek LLC:

Dt 76-2 Kt 60 \u003d 6,000 rubles - the shortage of roses is reflected in the accounting (base - invoice)

Dt 51 Kt 76-2 = 6,000 - the amount of the claim was returned;

Accounting records of Gvozdika LLC:

Dt 62 Kt 90-1 \u003d 6,000 rubles - the sale of roses for the amount of the shortage is reversed;

Dt 90-2 Kt 41 = 4,500 (45 rubles x 100 pieces) - the cost of the missing roses has been reversed;

Dt 90-3 Kt 68 = 915.25 rubles - VAT on missing roses reversed;

Dt 62 Kt 76-2 = 6,000 rubles - the claim from Vasilek LLC was taken into account.

Dt 76-2 Kt 51 = 6,000 rubles - money was transferred from the current account on the basis of a claim;

Dt 94 Kt 41 \u003d 4,500 rubles - writing off the cost of missing roses.

An investigation was conducted at Gvozdika LLC and it was revealed that the roses were stolen by the driver Krivenko for his own needs. The company ordered the driver to return the money for the stolen roses.

Dt 73-2 Kt 94 \u003d 6,000 - the amount of damage is reflected at the expense of Krivenko.

Dt 70 Kt 73-2 = 6,000 rubles - the shortage was withheld from Krivenko's earnings.

Since the employee agrees to pay the amount of damage on his own, his deductions per month cannot exceed 70% of earnings.

If the culprit is not found or the court denied your claim, the shortage is written off as losses.

Dt 91-2 Kt 94

If an arithmetic error is found in an account, the accounting entries are as follows:

Dt 76-2 Kt 60 - the amount of the claim is taken into account.

If an arithmetic error is detected after the posting of goods and materials, the entry is such

Dt 76-2 Kt 10 (41…) - the amount of the claim is taken into account.

See supplier complaint form

free book

Rather go on vacation!

In order to get a free book, enter the data in the form below and click the "Get the book" button.

In cases where, upon acceptance of goods and materials, errors are found in the supplier's documents (for example, in the price) or the bank erroneously deducted funds from the current account, as well as in other similar situations, a claim is made to the counterparty. We will tell you about what postings to claim in accounting, in our consultation.

Sub-account 76-2 "Calculations on claims"

Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n) for accounting for settlements on claims made against suppliers, contractors, transport and other organizations, as well as on presented and recognized (or awarded) fines, penalties and forfeits account 76 “Settlements with various debtors and creditors”, subaccount 2 “Settlements on claims” is used.

Analytical accounting on this sub-account is maintained for each debtor and claim.

Let's imagine standard accounting entries for accounting for settlements on claims:

| Operation | Account debit | Account credit |

|---|---|---|

| A claim was filed against suppliers, contractors and transport organizations for discrepancies in prices and tariffs identified after the posting of goods (works, services) to contracts, as well as in case of detection of arithmetic errors | 76-2 | 60 "Settlements with suppliers and contractors", 10 "Materials", 41 "Goods", etc. |

| A claim has been made against suppliers, incl. to organizations processing customer-supplied raw materials for discovered quality discrepancies with standards, specifications, orders | 60 | |

| A claim was made against suppliers, transport and other organizations for shortages of cargo in transit in excess of the amounts stipulated in the contract | 60 | |

| A claim has been made for marriage and downtime caused by the fault of suppliers or contractors, in amounts recognized by the payers or awarded by the court | 20 "Main production", 23 "Auxiliary production", 28 "Marriage in production", etc. | |

| A claim was made against the bank for amounts erroneously written off (transferred) from the accounts of the organization | 51 “Settlement accounts”, 52 “Currency accounts”, 66 “Settlements on short-term credits and loans”, etc. | |

| Accrued recognized as payers or awarded by the court to receive fines, penalties, forfeits collected from suppliers, contractors, buyers, customers, consumers of transport and other services for non-compliance with contractual obligations | 91-1 "Other income" |

Accordingly, accounting entries are made for the amounts of payments received on claims:

Debit of accounts 50 "Cashier", 51 "Settlement accounts", 52 "Currency accounts", etc. - Sub-account credit 76-2

And how does the supplier reflect postings on claims from buyers?

For the amounts of claims, fines, penalties recognized or awarded by the court, it is necessary to make an accounting entry:

Debit subaccount 91-2 "Other expenses" - Credit account 76

Account 76.2 is used to account for amounts and analyze transactions for claims and penalties issued by the buyer and received by the supplier. With the help of illustrative examples and specific situations, we will help you understand the rules for accounting for claims and the features of using account 76.2.

Account 76.2 accounting for claims settlements: use

Sub-account 76.2 reflects the amounts accounted for according to the claims letters received by suppliers and issued by customers.

Claim letters can be drawn up in connection with the unsatisfied terms of the concluded contracts, namely: (click to expand)

- violation of delivery terms;

- non-compliance of goods with qualitative (quantitative) characteristics;

- violation of the completeness of the goods, lack of necessary packaging, etc.;

- goods not delivered (works, services not performed).

The amounts of claims submitted are accounted for under Dt 76.2; for operations with received claims, Kt 76.2 is used.

Consider the main wiring:

| Debit | Credit | Description | Document |

| 76.2 | 20 | A claim for downtime (marriage) caused by the fault of the contractor was recognized. The amount of the claim is reflected at the expense of the costs of the main production | Claim letter |

| 76.2 | 23 (29) | A claim for downtime (marriage) caused by the fault of the contractor was recognized. The amount of the claim is reflected at the expense of the costs of auxiliary production (servicing facilities) | Claim letter |

| 76.2 | 28 | The amount of losses from marriages that arose through the fault of the contractor and are subject to recovery | Claim letter |

| 10 | 76.2 | The amount of the claim satisfied by the supplier of materials has been taken into account | Claim letter |

| 41 | 76.2 | The amount of the claim satisfied by the supplier of goods (due to their shortage) | Claim letter |

Accounting for customer claims

To consider operations on claims in accounting with the buyer, we use illustrative examples.

Claim for lack of delivery of goods

JSC "Fermer" supplied LLC "Ambar" a batch of materials (seeds of agricultural crops) in the amount of 134.800 rubles, VAT 20.563 rubles. The contract between "Farmer" and "Ambar" states that the loss of materials associated with the transportation process should not exceed 2.5%, that is, 3.370 rubles, VAT 514 rubles. (134.800 rubles * 2.5%).

Upon acceptance of the goods at the warehouse of Ambar LLC, a shortage of materials was revealed in the amount of 5.720 rubles, VAT 873 rubles. A claim was made for the amount of the identified shortage, according to which “Farmer” repaid the cost of the missing materials.

The following entries were made in the account of “Ambar”:

| Debit | Credit | Description | Sum | Document |

| 10 | 60 | A batch of seeds (134.800 rubles - 20.563 rubles - 5.720 rubles - 873 rubles) arrived at the warehouse of Ambar LLC. | 107.644 rub. | Bill of lading, Reconciliation act |

| 19 | 60 | The amount of VAT on actually received seeds was taken into account (20.563 rubles - 873 rubles) | 19.690 rub. | Invoice |

| 94 | 60 | The cost of seeds is taken into account, the amount of natural loss of which is provided for by the contract | 3.370 rub. | Contract of sale |

| 76.2 | 60 | A claim was made to “Farmer” for a shortage in the supply of materials in excess of the norm established by the contract (5.720 rubles - 3.370 rubles) | 2.350 rub. | Claim letter |

| 51 | 76.2 | Funds from the "Farmer" were credited to pay off the debt on the submitted claim | 2.350 rub. | Bank statement |

Advance payment not processed by the supplier

JSC "Segment" and JSC "Sector" concluded a contract for the supply of electrical goods:

- date of conclusion of the contract - 06/18/2015;

- On June 23, 2015, Segment JSC made an advance payment for electrical goods in the amount of 541,600 rubles, VAT 82,617 rubles. (100% prepayment);

- the delivery date of the goods is 03.08.2015.

JSC "Sector" did not deliver under the contract within the prescribed period, in connection with which "Segment" filed a claim demanding to terminate the contract and return the previously transferred advance. The claim was satisfied by Sector JSC in full.

The accountant of the Segment made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 60 Advances issued | 51 | Funds were transferred in favor of Sector JSC as an advance payment for the supply of electrical goods | 541.600 rub. | Payment order |

| 68 VAT | 76 VAT on advances issued | VAT from the amount of the advance transferred in favor of Sector JSC is accepted for deduction | 82.617 rub. | Invoice |

| 76.2 | 60 Advances issued | The amount of the claim made by Sector JSC for violation of the terms of supply of electrical goods has been taken into account | 541.600 rub. | Claim letter |

| 51 | 76.2 | Crediting funds from Sector JSC on a claim | 541.600 rub. | Bank statement |

| 76 VAT on advances issued | 68 VAT | The amount of VAT previously accepted for deduction has been restored | 82.617 rub. | Invoice, Claim letter, Bank statement |

Video reference “Accounting for account 76”: sub-accounts, postings, examples

Video lesson on accounting for account 76 “Settlements with different debtors and creditors”, sub-accounts, postings and examples of operations. Lead by the teacher of the site “Accounting and tax accounting for dummies”, chief accountant Gandeva N.V. ⇓

Operations with claims in vendor accounting

Let's consider examples of accounting for claims received.

Penalty for breach of contract

Hidden text

- delivery amount - 1.257.300 rubles, VAT 191.792 rubles;

- payment term under the contract - 18.03.2016;

- the amount of the penalty for violation of the terms of payment under the contract is 0.15% of the amount of the debt for each day of delay in payment.

Nefertiti LLC received payment for the shipped freezers on 03/25/2016, in connection with which Ramses JSC filed a claim containing the following calculation:

1.257.300 rub. * 0.15% * 8 days = RUB 15.088

The amount of the penalty was repaid by Ramses JSC in full.

The following entries were made in the accounting of Ramses JSC:

Satisfaction of the right to return the received advance payment

Mramor LLC and Kremniy JSC signed a contract for the supply of washing machines:

- date of conclusion of the contract - 03/03/2016;

- delivery time of the goods - 08.04.2016;

- delivery cost - 751.650 rubles, VAT 114.659 rubles.

03/12/2016 "Mramor" made a full prepayment under the contract, but the washing machines were not delivered on time. "Mramor" initiated the termination of the contract and filed a claim demanding the return of the advance paid earlier in favor of "Silicon".

After considering the claim, Kremniy returned the money and terminated the contract.

The accountant of Silicon made the following entries in the accounting:

| Debit | Credit | Description | Sum | Document |

| 51 | 62 Advances received | Crediting of funds received from Mramor LLC as an advance payment for the forthcoming delivery of washing machines | 751.650 rub. | Bank statement |

| 76 VAT on advances received | 68 VAT | VAT charged on the amount of the advance received from Mramor | 114.695 rub. | Invoice |

| 68 VAT | 51 | VAT amount transferred to the budget | 114.695 rub. | Payment order |

| 62 Advances received | 76.2 | Accounted for the amount of debt to LLC "Mramor" in connection with the violation of the terms and subsequent termination of the contract | 751.650 rub. | Claim letter |

| 76.2 | 51 | Funds were transferred in favor of Mramor LLC to pay off the debt on the received claim | 751.650 rub. | Payment order |

| 68 VAT | 76 VAT on advances received | The amount of VAT accrued earlier from the received advance is accepted for deduction | 114.695 rub. | Invoice, Claim letter |