What is the procedure for filling out an income tax return - an example. Procedure for filling out an income tax return Income tax filling out a return step by step

New form "Declaration on corporate income tax" officially approved by the document Order of the Federal Tax Service of Russia 10/19/2016 N ММВ-7-3/572@.

More information about using the "Organizational Income Tax Declaration" form:

- An example of filling out an income tax return when paying dividends

We will show you how to fill out separate sheets of the income tax return for organizations paying dividends. In the consultation “...we will show you how to fill out separate sheets of the income tax return for organizations paying dividends. The procedure for calculating the amount... to recipients of organizations paying dividends to Russian organizations (both JSC and LLC), in the income tax return... reduction by the amount of withheld tax), the amount of tax. Subsection 1.3 of section 1 of the income tax return...

- The procedure for filling out the income tax return for 9 months of 2016

Subdivisions (OU) of such organizations. Where should the income tax return be submitted? The income tax return for 9 months of 2016 ... late submission of the income tax return. The income tax return for 9 months of 2016 was submitted by the organization 11/15 ... exceeds 100 people, then submit The organization is obliged to file an income tax return in this very way (...

- Reflection in income tax and VAT returns of transactions related to the sale and redemption of bank bonds

Banks? How to reflect in income tax and VAT returns transactions related to... securities, as part of the income tax return, submit Sheet 05 (clause... II of the Procedure for filling out a tax return for corporate income tax (hereinafter referred to as the Procedure on profit), approved by order...: a new form of declaration for the income tax of organizations (G.P. Antonova, "Income tax: accounting for income and... 2015); What's new in the income tax declaration? (N. Chernyavsky, "...

- On submitting an updated income tax return

If an organization has discovered errors or failure to reflect any... Tax Code of the Russian Federation in its previously submitted income tax return. If an organization has discovered errors or non-reflections in a previously filed income tax return... . In this situation, the organization is not required to submit an updated income tax return. Overpayment of taxes included in...). When checking updated declarations, including income tax returns, the Federal Tax Service has the right to request...

- Advance payments for income tax: procedure and terms of payment

Thus, payments for corporate income tax at the end of the reporting period are calculated based on the results of economic activities... Thus, payments for corporate income tax at the end of the reporting period are calculated based on the results of economic activities... 2019, reflected in the tax return on the profit of organizations for the first quarter of 2019... When filling out sheet 02 “Calculation of corporate income tax” of the declaration, it is necessary to take into account some features. According to...

- If there is a profit tax loss for 2018

Confirming loss. When calculating income tax, organizations are given the right to take into account losses when... In 2018, an organization can also recognize when calculating income tax based on... the base" to sheet 02 of the income tax declaration of organizations (hereinafter referred to as the declaration), the form of which and Procedure... declarations for the reporting and tax periods of 2019. Sheet 02 Calculation of corporate income tax... declarations for the reporting and tax periods of 2020. Sheet 02 Calculation of corporate income tax...

- Advance payments for income tax. Examples

Income tax payments. An organization that pays income tax must pay advance payments for the specified tax based on the results of... income tax declaration of advance payments when paying monthly advance payments during the quarter of the Organization... apply the Accounting Regulations "Accounting for income tax calculations" organizations" ... the organization does not have a supplier of goods. The Organization pays advance payments for income tax quarterly...

- Detection of errors in calculating the income tax base relating to previous periods

Error (i.e. submitting an amended income tax return). Such explanations are given, in... zero. Does an organization have the right to reflect in its income tax return for 2017 (... which resulted in an overpayment of income tax, arose more than three years ago, the organization can correct... income tax returns in cases where: an error led to understatement of the tax calculated for payment under the declaration... clause 7.3 of the Procedure for filling out the income tax declaration, approved by the Order of the Federal Tax Service of Russia...

- Income tax disputes (Practice of the Supreme Court of the Russian Federation for 2018)

Tax liability based on the results of a desk audit of an updated tax return, but without... additional assessment by the tax authority of arrears for corporate income tax and property tax. Determination dated 07 ... reserve for doubtful debts declared by the Taxpayer in the updated tax return submitted ... came to the conclusion that the updated tax return for the tax inspection audited (... tax payable in a smaller amount than in the previous one ( primary) declaration...

- General and special income tax rates

Which the organization lost this status. Organizations - residents of the technology-innovative SEZ The rate for corporate income tax in... the part of crediting to the federal budget is set at 3% on... RIP has the right to apply reduced rates for corporate income tax subject to crediting to the federal budget... which is contained in the investment declaration that meets the requirements established by Federal Law...

- Payment by the FEZ participant of advance payments for income tax

Minus the calculated income tax for the first quarter. At the same time, the organization has a big problem... to pay profit tax to the budget of the Republic of Crimea at a rate of 2% and to submit a profit tax return from... based on the results of the first quarter. Example. Based on the results of the first quarter of 2016, the organization made a profit....2016 the organization became a participant in the SEZ in relation to all its activities. Profit for... advance payments based on the results of the reporting period. In other words, such organizations, in the absence of...

- The income tax rate is 0% when carrying out medical and (or) educational activities: there is little time left for its application

Income tax rates According to clause 3 of Art. 284.1 of the Tax Code of the Russian Federation, organizations have the right... it is established that the zero rate of income tax for medical organizations is applied, in particular, if..., within the deadlines established for submitting an income tax return (no later than March 28), they submit. .. the taxpayer's rate of 0% income tax is due not only to the organization's compliance with the general conditions provided for... the income tax rate on the total According to clause 7 of Art. 284.1 of the Tax Code of the Russian Federation of organizations...

- Income tax in 2017. Explanations from the Russian Ministry of Finance

When calculating the tax base for the corporate income tax, on the basis of Article 264 of the Tax Code of the Russian Federation... periods of updated calculations (tax returns) for the property tax of organizations in connection with the identification... for which the taxpayer submits an excise tax return in which the ...products can reduce the tax base for corporate income tax on the basis of subparagraph 49 of paragraph... when calculating the tax base for corporate income tax, on the basis of Article 264 of the Tax Code of the Russian Federation...

- What will change in the administration of VAT and income tax in 2018?

Positive character. Changes in income tax In relation to income tax, starting from 2018,... those not included in the taxable base for income tax are introduced. The taxable base will not... have the right to apply a zero tax rate on corporate income tax for tax periods with... expenses of the organization. Amendments to the income tax return are also likely to be adopted. Basic... the procedure for making symmetrical adjustments in the income tax return has not been established. Finally...

- Cash method for income tax purposes

Most organizations use the accrual method when calculating income tax. But there are those who... most organizations use the accrual method when calculating income tax. But there are those who... (works, services) for the purposes of calculating corporate income tax are determined in accordance with Article... the amount of advance payments for income tax from the beginning of the year; submit an updated income tax return. Accounting features...

The problem of correctly filling out and submitting an income tax return is now relevant, since it must be submitted before March 28. It is important to properly report individual expenses. In today’s article we will talk about how to correctly fill out and submit this report.

Income tax is paid by organizations using the basic taxation system. The tax payment deadline for the year is the same for everyone - until March 28 of the next year. The annual declaration is also submitted before March 28 for the previous reporting year.

Thus, payment of tax and submission of the declaration for 2017 must be carried out no later than March 28, 2018.

Advance payments and intra-year reporting

Throughout the year, advance payments are made for the tax in question and reporting is provided. The frequency is described in the following table.

Table 1. Deadlines for paying corporate income tax and filing returns

|

Payment method |

Deadline for payment of advance payment and submission of report |

Note |

|

Based on the results of the first quarter, half of the year and 9 months. with advance payments monthly in each quarter |

Common to organizations of any type and kind. |

|

|

Based on the results of the first quarter, half of the year and 9 months. without payment of advance payments made monthly |

Used by organizations: with income within 15 million rubles for the previous 4 quarters. for the quarter (implies sales revenue); Autonomous institutions, non-profit organizations without income, as well as budgetary institutions (without income from sales). |

|

|

Based on the results of each month, based on actual profits. |

Every month, until the 28th |

You will need to inform the Federal Tax Service by December 31 of the year before the tax period from which the transition to this system will be made |

A taxpayer who submits a report for 9 months makes advance payments for October, November, December during each of these months. The calculation takes into account the amount of income from sales. These do not include VAT and excise taxes for the fourth quarter. last year and I–III quarters. of the current tax period. If the specified limit is exceeded, the company pays advances monthly.

Find out about others coming soon.

Where to submit a company report with divisions

According to the rules, reporting on profits by organizations occurs at the location (of their own or separate divisions). If there is an OP, the following rules apply:

- At the location of the organization declarations are submitted for the organization as a whole, where profits are distributed among separate divisions. Such organizations additionally fill out Appendix No. 5 to Sheet 02 in an amount equal to the number of branches, including those closed this year.

- When organizational units are located in the same region It is allowed to pay tax and advances on it through one of the divisions - the responsible one. In this case, a declaration is submitted to the Federal Tax Service at the place of registration of the head office, as well as at the place of registration of the responsible OP.

- When the head office and OP are located in the same region It is possible not to distribute profits in relation to each of the divisions. That is, the parent company has the right to pay tax for all of its “isolations”. In this case, the profit report is submitted at the location of the parent organization.

- If the company has made a decision related to changing the procedure for tax payments or adjusting the number of structural divisions available on the territory of the subject, this is reported to the tax office.

Submission form

The income tax report is prepared based on the format that is approved By Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3/572@. If the average number of employees did not exceed 100 people for 2017, the declaration can be submitted on paper. Otherwise, only electronic form is acceptable.

The same order approved the procedure for filling out the declaration (Appendix No. 2, hereinafter Order).

Who fills out which sheets?

From the following table you can find out which sheets of the income tax return a company should fill out.

Table 2. Filling out declaration sheets for common operations

|

Chapter |

When filled |

Title page; Subsection 1.1 of section 1; |

Always by all taxpayers |

|

Subsection 1.2 section 1 |

If intra-quarter payments are paid once a month |

|

Subsection 1.3 of section 1 (“1” as a type of payment), sheet 03 (“A”) |

When paying dividends to legal entities |

|

Appendix No. 3 to sheet 02 |

Including when selling depreciable property |

|

Appendix No. 4 to sheet 02 |

Only for the first quarter and tax period |

|

Including expenses for voluntary medical insurance and training events for employees |

Other sections are filled in less frequently:

- Appendix No. 5 to sheet 02;

- sheets 03, 04, 05, 06, 07, 08, 09;

- Appendix No. 2 to the declaration.

The detailed procedure for filling them out is specified in paragraph 1.1 of the Procedure.

Filling out the declaration

It is optimal to fill out the declaration sheets in the following sequence:

Title page

In general, filling out the title page of this declaration is not much different from the others, but there is one feature - this is the tax period code. Let's consider filling out the title page line by line.

TIN- 10 digits of the code, with dashes in the last two cells.

checkpoint- code assigned by the inspection where the declaration is submitted.

Correction number- during the initial submission, a dash or “0--”.

Tax reporting period (code). Unlike other reports, an extended list of codes is used for the income tax return. They are given in Appendix 1 to the Procedure. There are several codes for the annual declaration:

- when paying quarterly payments - code 34;

- when paying monthly payments - code 46;

- when paying quarterly payments for a consolidated group of taxpayers - code 16;

- when paying monthly payments for a consolidated group of taxpayers - code 68.

Reporting year- in our case, 2017.

Submitted to the tax authority (code). The tax authority code is indicated in the AABB format, where AA is the region number, BB is the tax office number.

By location (registration) (code). Organizations that are not major taxpayers, do not have separate divisions, and are not a legal successor, indicate code “214”. All other codes are included in Appendix No. 1 to the Procedure.

Organization, separate division. The full name, including the legal form, is entered; dashes are placed in the remaining cells.

Economic activity type code- fits into the OKVED code of the main type of activity.

Block for reorganized/liquidated legal entities, which states:

- reorganization form code from Appendix 1 to the Procedure;

- TIN/KPP of a reorganized entity or a separate division.

Indicated number of declaration sheets, and if available, the number of sheets of supporting documents.

Below is confirmed data reliability, date and signature. The declaration can be signed by:

- Supervisor. In this case, the code “1” yes is indicated, and the last name, first name and patronymic of the manager are written in the following lines.

- Company representative - individual. In this case, code “2” is used and the full name of the representative is indicated.

- An authorized person of the company who is a representative of the taxpayer. Code “2” is used and is written in the full name of the authorized person. The name of the representative company is indicated below.

If the declaration is signed by a representative, the name and details of the document confirming his authority should be indicated in the appropriate field.

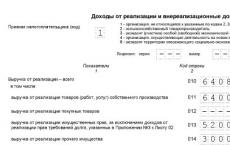

Appendix No. 1 to sheet 02

This section indicates income from sales and not related to it.

First of all, you need to select from the attached list taxpayer attribute. In general, this is code “1”. If there is a license, its details are indicated.

- V line 010 the total sales revenue is indicated;

- V line 011- revenue from sales of own products or services;

- V line 012- from the sale of previously purchased and then sold goods;

- V line 013- from the implementation of property rights;

- V line 014- from the sale of other property.

In the block lines 020-024 revenue from transactions with securities is reflected.

IN line 027 revenue received from the sale of the company as a property complex is reflected.

IN line 030 revenue from individual transactions from Appendix No. 3 to Sheet 02 is reflected.

Line 040 shows the total amount of sales revenue.

If there is revenue for the year that is not related to sales, you must fill out a block of lines 100-106:

- V line 100 the total amount of non-operating income is reflected;

- V lines 101-106 some of these revenues are being detailed.

Appendix No. 2 to sheet 02

This section indicates expenses associated with sales, as well as non-operating expenses, including losses equivalent to them.

IN line 010 The total amount of direct expenses for goods and services sold is reflected.

IN line 020 expenses on transactions related to trade are reflected.

IN line 030 The cost of purchased goods is indicated as part of the expenses reflected in line 020.

IN block of lines 040-055 indirect costs are indicated:

- On line 040 - their total amount;

- For the remaining lines - their details. Here are some popular types of expenses:

- line 041 indicates the amount of taxes and fees paid;

- in line 042 - capital investment costs;

- in line 047 - expenses for the acquisition of land plots;

- in line 050 - R&D expenses.

IN line 060 reflects the cost of other property that was sold, as well as expenses associated with its sale.

If the enterprise was sold as a property complex, in line 061 the value of its net assets is indicated.

Lines 070 and 071 are intended for professional participants in the securities market.

Lines 072 and 073 are filled in if the company incurred expenses in connection with investments in securities and shares.

IN lines 090-110 Losses associated with service production facilities and the sale of property and land are reflected.

By line 130 recognized expenses are reflected in the total amount.

In relevant block lines 131-134 the amount of depreciation is indicated, including (in a separate line) for intangible assets. IN line 135 you need to indicate the code corresponding to the depreciation calculation method specified in the accounting policy (“1” - linear, “2” - non-linear).

IN block lines 200-206 the amount of non-operating expenses is indicated with detail.

IN block lines 200-206 the amount of non-operating expenses is indicated with detail.

IN block of lines 300-302 losses equivalent to expenses are indicated, namely:

- losses from previous periods identified in the current year (line 301);

- bad debts not covered by the corresponding reserve (line 302).

Block of lines 400-403 is intended to reflect adjustments to the tax base of previous periods due to errors (link).

Sheet 02

Sheet 02

Sheet 02 is the section in which the tax amount is calculated. Consists of two parts.

IN blocks of lines 010-060 The organization's income and expenses are collected and the financial result is calculated.

Lines 010-050 are filled out based on the annexes to Sheet 02. B line 060 profit or loss for the year is calculated. In the following image you can see that each of these lines has an explanation of where the indicators should be taken from:

IN line 070 income that is excluded from profit is reflected (income on certain debt obligations, from participation in foreign organizations, and others).

IN line 100 The tax base is calculated.

If a loss from previous periods or part thereof is written off against profit, this amount is reflected in line 110.

IN line 120 taxable profit is calculated taking into account line 110.

In the block lines 140-170 tax rates are indicated - in total and for budgets of different levels.

In the block lines 140-170 tax rates are indicated - in total and for budgets of different levels.

IN line 180 The amount of calculated tax is reflected, including:

- to the federal budget - indicated in line 190;

- to the subject's budget - to line 200.

Line 210 is intended to reflect the total amount of advance payments paid within the year. IN lines 220 and 230 this amount is detailed by budget level.

Line 210 is intended to reflect the total amount of advance payments paid within the year. IN lines 220 and 230 this amount is detailed by budget level.

If a company paid tax abroad on the basis of Article 311 of the Tax Code of the Russian Federation, it must fill out lines 240-260. Trade tax payers indicate indicators in lines 265-267.

If a company paid tax abroad on the basis of Article 311 of the Tax Code of the Russian Federation, it must fill out lines 240-260. Trade tax payers indicate indicators in lines 265-267.

Lines 270-281 are resultant. They reflect the tax:

- for additional payment to the federal budget - in line 270;

- for additional payment to the subject's budget - in line 271;

- to a reduction in the federal budget - in line 280;

- to a reduction in the subject’s budget - in line 281.

IN line 290 indicates the amount of monthly advance payments to be paid next year. IN lines 300 and 310 this amount is broken down by budget. This block, like the block of lines 320 - 340, is not filled out when filing a declaration for the year.

If the company participates in regional investment projects, you should also fill out lines 350 and 351.

Subsection 1.1 Section 1

Section 1 reflects the results of the calculation, that is, the amount of tax payable to the budget. Subsection 1.1 is intended for those taxpayers who make advance payments.

In this subsection you must fill in:

- line 010- OKTMO;

- line 030- KBK for tax to the federal budget;

- line 040- the amount of tax to be paid additionally to the federal budget (if the amount is negative, it is indicated in line 050- to decrease);

- line 060- KBK for tax to the budget of a constituent entity of the Russian Federation;

- line 070- the amount of tax payable to the regional budget (a negative amount is indicated in line 080- to decrease).

Sanctions

Sanctions

There are various penalties for failing to file your income tax return or filing it late.

Firms that are late with annual reporting will pay a fine 5% from the amount of tax unpaid on time for each full or partial month of delay. The amount of the fine will be:

- at least 1 thousand rubles (usually as a fine for late submission of a zero declaration);

- no more than 30% of the amount of tax that is not paid on time.

Those who are late with the declaration for the reporting period in the form of 1 month, 2 months, quarter, half year, 9 months, etc. will pay fine 200 rubles for each declaration, submitted untimely.

Company officials may be fined up to 300–500 rubles according to Art. 15.5 Code of Administrative Offenses of the Russian Federation. An official can be not only a manager, but also any employee. For example, the chief accountant, if he is assigned the obligation to submit reports in a timely manner.

Delays with annual declarations by 10 days may result in the company account being blocked.

Penalties are charged for late payment of taxes. In case of non-payment of tax caused by an error that led to an underestimation of the tax base, the organization faces a fine of 20% of the amount of arrears based on paragraph 1 of Article 122 of the Tax Code of the Russian Federation.

To avoid a fine, a “clarification” is submitted with advance payment of arrears and penalties.

Updated declaration

The following cases are provided for filing an updated declaration:

- if an error was discovered in the declaration that was previously submitted and incomplete payment of tax resulted in Expenses are overstated or income is understated;

- if received requirement from the Federal Tax Service provide clarifications or make corrections.

The error that caused the overpayment of tax is corrected in the declaration in a given tax period.

The “updated form” is filled out in the same composition as the initial declaration. Without exception, all sheets, sections and appendices are filled out as in the primary declaration (even if there are no errors in them).

An updated declaration is submitted upon request of the inspection within 5 working days from the moment the request is received. If you do not have time and do not submit an explanation, a fine of 5 thousand rubles will follow based on paragraph 1 of Article 129.1 of the Tax Code of the Russian Federation.

If you independently identify an error, there is no deadline to submit a “clarification” to the Federal Tax Service, but it is better to be prompt. Because underestimation of tax payable will be detected by the inspectorate, and this will lead to a fine.

Features of filling out the declaration

Filling with lines 290 Liszt 02

This line filled in by firms making advance payments once a quarter, and within each quarter - monthly advances. The purpose of the line is to indicate the total amount of advances to be paid each month in the next quarter. What to indicate in this line can be seen from the following table.

Table 2. Line 290 of Sheet 2

* Note. If the result is “0” or a negative value, a dash is added.

Non-operating expenses

To reflect non-operating expenses, it is provided line 200 in Appendix 2 to Sheet 02. The following expenses are subject to separate decoding:

- line 201 - interest on credits (loans) and securities (bills);

- line 204 - expenses associated with the liquidation of fixed assets, or other expenses under subparagraph 8, paragraph 1 of Article 265 of the Tax Code of the Russian Federation;

- line 205 - contractual sanctions and funds aimed at repaying damage.

IN line 300 of application 2 sheets 02 losses that are considered non-operating expenses are reflected, for example, losses discovered in the reporting year from previous years, losses caused by production downtime and natural disasters.

The loss is recorded in this year's declarations in line 060 on Sheet 02 and in line 160 of Appendix No. 4 to sheet 02.

Changes to the rules for carrying forward losses from previous years

Separately, it should be said about the change in the procedure for reducing the tax base associated with losses for previous years. New rules are in effect from 01/01/2017 to 31/12/2020. The changes are:

- the reduction is limited, that is, the tax base can be reduced by no more than by 50%(this does not affect tax bases with reduced tax rates);

- the transfer period is no longer limited (compared to up to 10 years previously);

- the new procedure applies to losses received during tax periods from January 1, 2007.

Based on changes in the declaration, the following are filled out:

- Line 110 of sheet 02, lines 010, 040–130, 150 of Appendix No. 4. In this case, the amount of loss reducing the base in line 150 does not exceed 50% of the amount in line 140;

- Line 080 of sheet 05;

- Lines 460, 470, 500, 510 of sheet 06. The amount of loss in lines 470 and 510 is less than 50% of the amount in lines 450 and 490, which reflect the investment tax base.

Reflecting symmetrical adjustments

If symmetrical adjustments are reflected in Sheet 08 declaration indicating codes “2” or “3”, in the details called “Type of adjustment” the following is entered:

- the number “0” in column 3 “Attribute” for an adjustment that reduced income from sales (line 010 of sheet 08) or income not received from sales (line 020 of sheet 08);

- the number “1” in column 3 “Attribute” for adjustments that increased expenses and decreased income from sales (line 030 of Sheet 08) and non-operating income (line 040).

In column 3 “Sign” and line 050 of Sheet 08 does not require entering “0” or “1”. The adjustment amount is reflected here without taking into account the sign.

About insurance premiums, direct and indirect costs

Taxpayers independently establish a list of direct expenses, defining it in their accounting policies. Appendix No. 2 to sheet 02 The income tax return contains the following indicators:

- V line 041- contributions for compulsory pension and health insurance, contributions for temporary disability and maternity in relation to the income of a managerial person;

- V line 010- insurance premiums with wages of production employees.

In connection with the last point, we should highlight the concept indirect costs. Indirect costs should be considered the costs of production and further sale of goods, taken into account in the expenses of the period. Costs that are not designated in the accounting policies as direct expenses do not belong to them. Since these are non-operating expenses, they should be designated as indirect expenses.

The income tax return contains an indication of the amount of indirect expenses in line 040 of Appendix No. 2 to sheet 02. Expenses are partially deciphered in lines 041–055.

Line 041 implies taxes and advance payments in respect of fees and insurance premiums that relate to other expenses:

- transport taxes;

- property taxes from book or cadastral value;

- land tax;

- restoration of VAT (Article 145 of the Tax Code of the Russian Federation);

- National tax;

- making contributions to pension, health insurance, as well as temporary disability.

In the process of filling out line 041 within the reporting period, the taxpayer records the amount of tax accruals, the transfer of advance payments and fees, and insurance contributions on an accrual basis. In this case, the date of payment to the budget does not play any role.

IN line 041 of appendix 2 to sheet 02 not reflected:

- Taxes and advance payments, other obligatory payments that are not subject to accounting in tax revenues:

- income tax;

- UTII;

- outgoing VAT;

- payment for pollution emissions when standard values are exceeded;

- trading fees.

- Contributions for injuries.

Direct expenses represent production costs. They are indicated in the list fixed by the organization in its accounting policies.

Direct production costs include:

- costs of raw materials and supplies for production;

- production and necessary insurance premiums;

- depreciation on fixed assets used in production.

The amount of direct expenses for income tax purposes is reflected in the tax return. line 010 of Appendix No. 2 to sheet 02. Here the amount is recorded on an accrual basis from the beginning of the year.

Expenses in line 010 expenses must be documented.

Values in lines 010, 020 and 040 included in the amount lines 130 the same sheet. This value, in turn, is transferred to line 030 of sheet 02 tax return.

Table 3. Reflection of certain types of costs when calculating income tax

| Type of expenses | Accounting for the purpose of calculating income tax |

| Salary | Payment expenses are a list that is not limited in any way. Such expenses include all charges provided for by law or contract. Thus, any PO expenses can be recognized if they:

|

| Awards | Bonuses for achieving high production results are included in the expenses provided for remuneration. Based on Art. 129 of the Labor Code of the Russian Federation, incentive payments are elements in the remuneration system. This must be established by agreement and enshrined in a local act. There are restrictions given in Art. 270 Tax Code of the Russian Federation. Remuneration paid to employees or management that is not specified in employment contracts is not included in salary expenses. The same is true for bonuses, which are paid out of the company's net profits. It is not classified as an expense because it is not related to the achievements of employees in production. |

| Sport | Sports activities in the work team during non-working hours that are not related to the activities of employees at work are not taken into account in expenses |

| Foreign taxes | Taxes and fees paid in another country are written off as other on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation. This does not take into account taxes for which the legislation of the Russian Federation directly provides for a mechanism for eliminating double taxation (including this established for profit). |

| Work records | The cost of work books is included in tax and accounting expenses. The amount received from the employee as compensation for these expenses is included in non-operating income. |

Sample of filling out the declaration

Title page

Title page  Section 1, subsection 1.1

Section 1, subsection 1.1

Sheet 02

Sheet 02

Sheet 02, continuation

Sheet 02, continuation  Appendix 1 to Sheet 02

Appendix 1 to Sheet 02  Appendix 2 to Sheet 02

Appendix 2 to Sheet 02

Appendix No. 2 to Sheet 02, continued

Appendix No. 2 to Sheet 02, continued  Appendix No. 3 to Sheet 02

Appendix No. 3 to Sheet 02  Appendix No. 3 to Sheet 02

Appendix No. 3 to Sheet 02

Appendix No. 4 to Sheet 02

Appendix No. 4 to Sheet 02

Normative base

- Order of the Federal Tax Service of the Russian Federation dated October 19, 2016 No. ММВ-7-3/572@ “On approval of the tax return form for corporate income tax, the procedure for filling it out, as well as the format for submitting a tax return for corporate income tax in electronic form”;

- Tax Code of the Russian Federation (Part Two), Chapter 25. INCOME TAX OF ORGANIZATIONS;

- Letter of the Federal Tax Service of Russia dated January 09, 2017 No. SD-4-3/61@ “On changing the procedure for accounting for losses of past tax periods”;

- Letter dated 04/26/2017 No. SD-4-3/7955@ “On issues of filling out a tax return for corporate income tax under the Group of Groups of Companies.”

With regard to income tax, the deadlines for filing returns in 2017 are determined by the Tax Code of the Russian Federation. However, let us say right away that legislators have not determined new deadlines for 2017. Therefore, the deadlines have not changed. Next, we provide a table with the deadlines for submitting the income tax return in 2017 and remind you on what form to submit the declaration.

Deadlines for filing income tax returns: general rule

Organizations are required to report their profits at the end of the year. The income tax return for the year (tax period) must be submitted no later than March 28 of the year following the reporting year (clause 4 of Article 289 of the Tax Code of the Russian Federation). But this does not mean that you only need to send a declaration to the inspectorate once a year. According to Articles 285 and 289 of the Tax Code of the Russian Federation, all companies must also summarize interim results.

The reporting periods for income tax are the first quarter, half a year and nine months. (Clause 2 of Article 285 of the Tax Code of the Russian Federation).

The declaration for each reporting period must be submitted to the Federal Tax Service no later than the 28th day of the month following this period. The specific deadlines for submitting the declaration depend on how the organization pays advance payments (clause 2 of Article 285, clause 1 of Article 287, clause 3 of Article 289 of the Tax Code of the Russian Federation):

- or the organization pays quarterly advance payments in 2017;

- or the organization pays monthly advance payments in 2017 based on actual profits.

The organization pays quarterly advance payments

If in 2017 the company makes quarterly advance payments, then the declaration of profit received must be submitted to the Federal Tax Service no later than the 28th day of the month following the end of the quarter (if it falls on a weekend or holiday, the deadline is postponed to the next working day). Below in the table we show the deadlines for submitting the income tax return in 2017 when submitted quarterly.

This new declaration form came into force on December 28, 2016. This means that starting with reporting for 2016, organizations must submit a declaration using a new form. That is, for all the periods of 2017, which you can see in the tables above, you need to use exactly this (new) income tax return form.

At the end of each reporting and tax period, they are required to submit an income tax return to the Federal Tax Service.

If a company pays quarterly advances, it submits a declaration 4 times a year (based on the results of 3 quarters and an annual one).

If a company pays monthly advances based on actual profits, then it submits the declaration 12 times.

note, if in the reporting (tax) period the organization had no profit and there was no movement in its current accounts and cash register, it can submit a single simplified declaration to the Federal Tax Service.

Income tax return form

Download the income tax declaration form (KND form 1151006), valid in 2019 (download the form).

Note: the tax return form (for reporting in 2019), the procedure for filling it out and the format for submitting it electronically are approved by Order of the Federal Tax Service of Russia dated October 19, 2016 N ММВ-7-3/572@).

Sample of filling out a declaration in 2019

Income tax declaration for organizations on the OSN in 2019 (filling sample).

Deadline for filing income tax returns

Taxpayers submit declarations at the end of each reporting and tax period.

Reporting periods for organizations paying quarterly advances are 1st quarter, half year And 9 months.

For organizations that have chosen the procedure for monthly payment of advances based on actual profit, the reporting periods are month, two month, three months and so on up to 11 months.

Declarations based on the results of the reporting period are submitted to the Federal Tax Service no later than 28 days from the end of the reporting period.

Deadlines for filing tax returns at the end of the reporting period

Table No. 1. Deadlines for submitting the declaration depending on the method of payment of advances

| Reporting period | Quarterly advances | Monthly advances based on actual profits |

|---|---|---|

| January | — | 28.02.2019 |

| February | — | 28.03.2019 |

| March | — | 29.04.2019 |

| I quarter 2019 | 29.04.2019 | — |

| April | — | 28.05.2019 |

| May | — | 28.06.2019 |

| June | — | 29.07.2019 |

| Half year 2019 | 29.07.2019 | — |

| July | — | 28.08.2019 |

| August | — | 30.09.2019 |

| September | — | 28.10.2019 |

| 9 months 2019 | 28.10.2019 | — |

| October | — | 28.11.2019 |

| November | — | 28.12.2019 |

| December | — | — |

Fines for late submission of the declaration:

- 1,000 rub. – if the annual declaration is not submitted, but the tax is paid on time or the “zero” declaration is not submitted on time;

- 5% of the amount payable under the declaration for each month of delay, but not more than 30% in total and not less than 1,000 rubles. – if the tax is not paid;

- 200 rub. – if the declaration (tax calculation) based on the results of the reporting period is not submitted on time.

Note: declarations based on the results of the reporting period are inherently tax calculations, and therefore the Federal Tax Service does not have the right to fine an organization under Article 119 of the Tax Code of the Russian Federation if an income tax calculation is not submitted, despite the fact that in the Tax Code of the Russian Federation these calculations are called declarations. The fine for failure to submit a calculation is levied exclusively under Art. 126 of the Tax Code of the Russian Federation.

Methods for filing corporate income tax returns

Organizations must submit declarations:

- To the Federal Tax Service at the place of your registration.

- To the Federal Tax Service at the place of registration of each separate division.

Note: if an organization is the largest taxpayer, it must report at its place of registration.

An income tax return can be sent to the tax authority in three ways:

- In paper form (in 2 copies) in person or through your representative. When submitted, one copy of the report remains with the Federal Tax Service, and the second is marked with acceptance and returned. A stamp indicating the date of receipt of the declaration in the event of controversial situations will serve as confirmation of the timely submission of the document;

- By mail in a valuable letter with a list of the contents. Confirmation of sending the declaration in this case will be a list of the attachment (indicating the sent declaration) and a receipt with the date of sending;

- In electronic form via TKS (through electronic document management operators).

Note: to submit a declaration through a representative, it is necessary to draw up a power of attorney for him, certified by the seal of the organization and the signature of the manager.

note, when submitting reports on paper, some Federal Tax Service Inspectors may require:

- Attach the declaration file in electronic form on a floppy disk or flash drive;

- Print a special barcode on the declaration that duplicates the information contained in the reporting.

These requirements are not provided for by the Tax Code of the Russian Federation, but are encountered in practice and may lead to refusal to accept the declaration. If this happens, the fact of refusal to accept can be challenged with a higher tax authority (especially if the refusal resulted in missing the deadline for submitting the document and additional penalties being assessed).

The absence of a two-dimensional barcode, as well as incorrect indication of the OKTMO code (if there are no other comments and the declaration complies with the established form), cannot be reasons for refusal to accept the declaration (this is directly stated in the Letter of the Ministry of Finance of the Russian Federation dated April 18, 2014 No. PA -4-6/7440.

How to fill out an income tax return

You can download the official instructions for filling out the declaration from this link.

Basic rules for filling out the declaration

Filling out an income tax return through special services

You can also fill out your income tax return using:

- Paid Internet services (“My Business”, “B.Kontur”, etc.);

- Specialized accounting companies.

Call now: 8 800 222-18-27

Download the new income tax return form for 2019 in MS EXCEL

The current form was approved by Order of the Federal Tax Service dated October 19, 2016 No. ММВ-7-3/572@ “On approval of the form of the tax return for corporate income tax, the procedure for filling it out, as well as the format for submitting the tax return for corporate income tax in electronic form.”

This tax return form is subject to application, starting with the submission of a tax return for corporate income tax for 2016-2019.

Income tax return form for 2016-2019

Form income tax returns The BukhSoft program will fill in automatically according to tax accounting data.

Instructions for completing your income tax return

The rules for preparing income tax returns are specified in the appendices to the Federal Tax Service order No. ММВ-7-3/572@ dated October 19, 2016.

Formation of income tax returns in electronic form

The format is approved by Appendix No. 3 to the Order of the Federal Tax Service of October 19, 2016 No. ММВ-7-3/572@ (version 5.07)

- new barcodes on all pages of the declaration;

- income type code 3 in section B of sheet 03 (this is the code for income on bonds subject to income tax at a rate of 15%);

- on sheet 08 there will be information about the transaction for which the organization made an independent, symmetrical or reverse adjustment (for example, the number and date of the contract, the name of the subject of the transaction).

They also plan to adjust the procedure for filling out the declaration: the indicator on line 150 of Appendix No. 4 to Sheet 02 will need to be filled out taking into account the 50% limit for transferring losses.

Added from the 2016 report:

- Lines for trade fee. Starting from 2015, organizations have the right to reduce the profit tax calculated for payment to the budget of a constituent entity of the Russian Federation by the amount of the trade tax actually paid. However, there were no corresponding lines in the declaration, so the amounts had to be reflected in lines 240 and 260 of the old form “Amount of tax paid outside the Russian Federation...” (on the recommendation of the Federal Tax Service), now the necessary lines have appeared in the declaration (Sheet 02 pp. 265 - 267 ).

- Taxpayer identification for participants in the free economic zone of the Republic of Crimea and the city of Sevastopol, residents of the free port of Vladivostok. For these categories of organizations, reduced income tax rates are provided (0% - federal budget; 13.5% (and lower) - regional budget), but there was no corresponding indicator in the declaration, so all organizations indicated the taxpayer indicator “3” - resident special economic zone. In the new declaration, the characteristics of taxpayers are divided into:

- Code “3” will be indicated by residents of the free economic zone for activities related to the inclusion of the organization in the register of residents of the free economic zone.

- Code “6” will be indicated by organizations that are residents of territories of rapid socio-economic development.

- Sheet 08 for the taxpayer to independently adjust the tax base and the amount of tax (losses) if he uses prices in a transaction between related parties that do not correspond to market prices.

- Sheet 09 for taxation of profits of controlled foreign organizations.

Download the income tax return form for 2014-2015 in MS EXCEL

The income tax return was approved by Order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3/600@ "On approval of the form of the tax return for the income tax of organizations, the procedure for filling it out, as well as the format for submitting the tax return for the income tax of organizations in electronic form."

This tax return form is subject to application, starting with the submission of a tax return for corporate income tax for 2014.

The income tax return in the BukhSoft and Bukhsoft Online programs is filled out automatically according to tax accounting data.